Krugman, 22 Jan 2012, Notes on Deleveraging, links to the McKinsey Global Institute report on debt and deleveraging. The McKinsey page says

history shows that, under the right conditions, private-sector deleveraging leads to renewed economic growth and then public-sector debt reduction.

What I've been saying. In order to get the economy to grow, we must reduce private debt. Not public debt. Private debt.

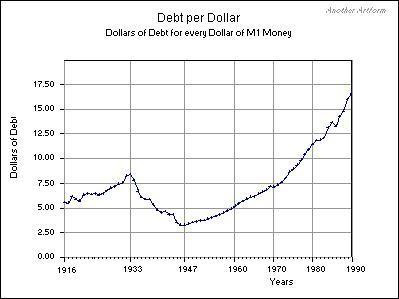

The "history" to which McKinsey refers would look something like this:

|

| Graph #1: Debt per Dollar, 1916-1990 |

Up until we had a Great Depression...

Down until we got a Golden Age... and

Up again, until we could bear it no longer...

| Graph #2: Debt per Dollar, 1916-2010 |

Like that.

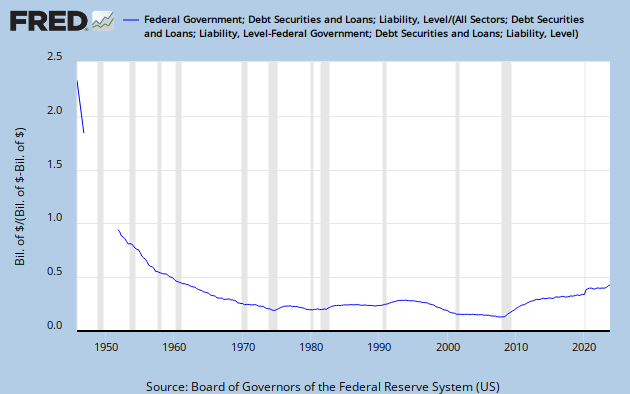

Oh, and yes, the public debt fell continuously all during the Golden age. And when it was low and could go no lower, there was an end of the Golden Age, and the start of troubles that continue to this day.

|

| Graph #3: The Federal debt compared to the rest of Total Debt |

And that's the way it is...

2 comments:

Art,

I think you will find this interesting and up your alley

Moritz Schularick: Credit Booms Gone Bust

Quote:

About the Interview

Carmen Reinhart and Kenneth Rogoff tell the history of financial crisis as a tale of excessive public debt. But what more commonly drives financial instability, says Moritz Schularick, is excessive private debt. Financial crises are credit booms gone bust. Schularick and his collaborators compile a long-run data set of disaggregated credit flows, separating loans for productive investment from loans for the purchase of existing assets. A marriage of economic history and modern statistical methods to investigate the role of finance in the macroeconomy -- this is new economic thinking.

It's good to see the concern with private debt. Schularick had a good comment about Reinhart and Rogoff in there too. Thanks for the link.

Post a Comment