This series of posts began on 18 November

EDIT, 3 DECEMBER 2014

Normally, I don't change my posts. This one has been undergoing major revision, because I don't want to steer anyone wrong who might use it as an instllation guide. So, this isn't the same post it was at the start.

IF YOU DON'T INSTALL G7 CORRECTLY, IT WILL GIVE YOU PROBLEMS. I HAVE TO KEEP EDITING THIS POST UNTIL I GET THE INSTALLATION RIGHT. I THINK WE'RE THERE NOW.

BUT, YEAH, I DID THINK WE WERE THERE BEFORE, TOO.

Inforum's

The G7 Regression Program page is pretty friendly. And you can download the G7 from there.

So that's where I went, and clicked the shiny button to "Get G7 Here"

That took me to the Software Downloads page

Then I clicked the blue PDG link for the "Stable" version

PDG.exe, 26.3 meg

It's taking a few minutes...

The Software Downloads page says you have to "unblock" the file after the download. While waiting, I looked that up.

Delay's Blog says "ZIP files should be "unblocked"

before their contents are extracted."

http://blogs.msdn.com/b/delay/p/unblockingdownloadedfile.aspx

TechNet says "By default, these files are blocked to protect the computer from untrusted files" and wants you to "review the file and its source and verify that it is safe to open."

(I forgot to grab the TechNet link.)

Nobody says how you're supposed to know if something is "safe".

The download took five minutes. I moved the file to a "temp" folder, unblocked it, and ran it.

WHEREVER YOU RUN THE DOWNLOAD FILE, IT CREATES A PDG FOLDER AND PUTS ITS FILES IN THAT FOLDER. SO MY CONCERN ABOUT LITTERING C:\ WITH FILES WAS UNFOUNDED. IT'S A SMART CONCERN, BUT IT WAS UNFOUNDED.

WHEN YOU RUN THE PDG.EXE DOWNLOAD FILE YOU GET SETUP.EXE AND A HANDFUL OF RELATED FILES. (I SHOW A SCREEN SNIP BELOW.)

I'm using Windows Vista, by the way, and hoping to upgrade at Christmas...

I didn't know what to do next. But the Software Downloads page starts by saying: "To install

G7 on a machine for the first time, please follow the instructions on the

G7 page." So I clicked that, and ended up back at the friendly page. It says:

PDG - This is a self-extracting ZIP file of the G7 program and other Inforum software. After downloading this file, run it by double-clicking on it, or by typing its name at a DOS prompt. Do this in a temporary directory. One of the files that will be extracted is SETUP.EXE. Next, run this setup program, and the InstallShield session will begin. This will load the software into the default location of C:\PDG. See the Readme files that are included in the installation for further instructions.

So far so good. Next, run setup.exe, the InstallShield Wizard.

A pretty picture of a house (or maybe, the building that houses

Inforum) comes up in the InstallShield Wizard. After clicking "next" a couple times, a readme file comes up. This is not like something that I might throw together myself. It is all very professional. Trustworthy.

"307 file(s) unzipped successfully."

WHEN YOU RUN SETUP.EXE YOU GET THOSE 307 FILES.

OKAY.

FIRST YOU DOWNLOAD A FILE NAMED

PDG.EXE AND UNBLOCK IT. THEN YOU RUN IT, AND WHEREVER YOU RUN IT, BY DEFAULT IT CREATES A FOLDER NAMED

PDG AND IT PUTS A HANDFUL OF FILES IN THERE... INCLUDING

SETUP.EXE.

It wanted to extract to c-root,

C:\ and this time I let it. Here is the result:

A handful of files, including

SETUP.EXE, in a PDG folder. Then I ran the SETUP.EXE:

THEN YOU RUN

SETUP.EXE, AND BY DEFAULT IT CREATES A

PDG FOLDER IN THE ROOT, AND PUTS 307 FILES THERE... INCLUDING

G7.EXE, THE FILE YOU WANT.

I let it install in

C:\ and here is the result of that:

The installed files are in a PDG folder which is in C:\. It works, if you let it.

Oh good, Windows Vista is given as an example of the environment you might be using for G7. The first stuff I read on this a few days back said Windows XP or 7 or 8 but didn't mention Vista. So far so good, then.

The readme says you have to add C:\PDG (the path to where G7 will be installed) to the Windows PATH variable. I did that right away because I wouldn't remember to do it after the installation is complete. The instructions are right there in the readme, and they are excellent. I didn't have any question in any step of the process. When they tell you to click OK, they also tell you which window you should be in at the moment, and I was in that window every time. I think that's the best computer instructions I ever saw.

THE INSTRUCTIONS ARE VERY GOOD. MY PROBLEMS AROSE BECAUSE I DIDN'T TRUST THEM, AND I TRIED TO DO THINGS TO PREVENT PROBLEMS. MY PROBLEMS AROSE FROM MY EFFORT TO PREVENT PROBLEMS. SAD BUT TRUE.

Oh, I'm gonna quote this bit for later:

To employ some of the newest features in G7, your system must have an installation of the Microsoft VC++ 2005 Redistributable package. You can find a copy of the VC++ installer under C:\PDG\VC++Installer. Run the installer before attempting to run G7.

Run the installer before attempting to run G7... but

after I install G7. Which I didn't get to yet. I'm still reading the readme.

Okay, I'm done with the readme.

There are some questions related to installation. I just accept the defaults, unless I see something odd.

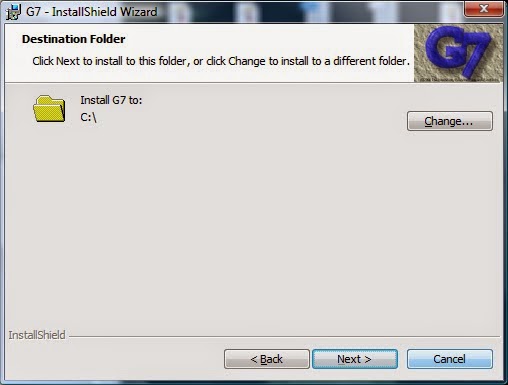

I see something odd. The InstallShield Wizard's

Destination Folder window by default will install G7 to the root directory

C:\ YEAH AND THAT IS OKAY!!! INSTALLSHIELD WILL CREATE THE PDG FOLDER IN THE ROOT DIRECTORY (AND THAT IS WHAT I WANT!) AND WILL PUT ALL THE INSTALLED FILES INTO THE NEW PDG FOLDER. IT WILL WORK FINE, IT YOU LET IT.

LEAVE INSTALLSHIELD THE DEFAULT PATH C:\ AND YOU'RE GOOD. I clicked next.

The "Typical" setup type installs everything. That's the default and that's what I want.

Now, click Install...

Start 5:12 AM...

After a moment the activity begins...

Oh, done! at 5:14.

Readme? Yes...

Yeah, this is the same readme file that I read before. I had to do something... Run the installer for VC++

Okay, now I can close the Temp folder and the Temp\PDG folder, and open C:\PDG.

VC++ Installer is there. It installs quickly but then there is a long delay while it says "time remaining 0 seconds"... but the window closed while I was typing this. Okay.

Close the VC++ Installer folder...

Close the Readme window...

Close the Control Panel window where I add PDG to the path...

Now I don't know what to do. Run the thing, I guess.

In the GDP folder I double clicked on G7.EXE and two windows opened. It's a demo. The one window is the demo and the other is the script for the demo, it looks like. But nothing is happening. In the script I see things like "When you are done reading, Click OK" but they don't show up in the demo.

Maybe I have to *run* it?

I click the triangle symbol in the demo window menu, the right-pointing triangle. The thing runs, I get a paragraph of text, and a "When you are done reading, Click OK" message.

Okay.

.png)

%2Bsince%2B1970.png)

%2BEndo%2BExo.png)