Financial debt is the debt that is needed to permit the growth of debt of the productive sector. Think of it as an underlying cost.

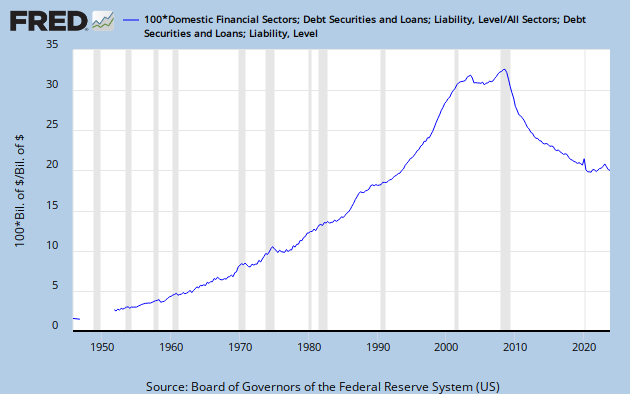

Graph #1 shows financial debt as a percent of total (public and private) debt:

| Graph #1: Financial Debt as a percent of Total Debt |

And if we judge by the way the uptrend stopped short after the 2001 recession, it looks like that increase was unsustainable.

How can that be?

This is how:

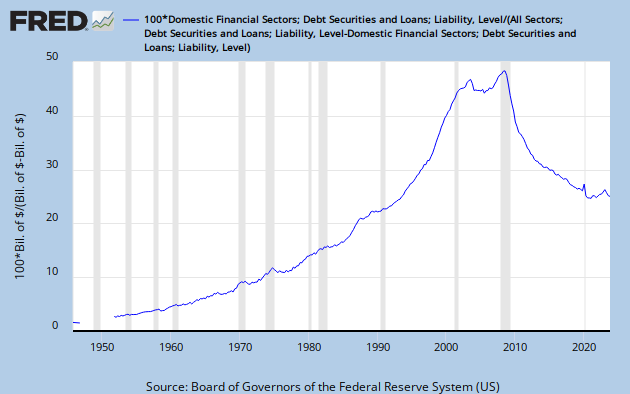

| Graph #2: Financial Debt as a percent of Productive Debt |

Financial debt rose until it was almost half as much as all the non-financial debt counted in total (TCMDO) debt. Almost half. That means that for every dollar of interest some poor sucker might have been paying on his own debt, he was paying almost 50 cents more for the underlying debt of the lenders who lent him that money.

Excessive reliance on credit is unsustainable policy.

This is important. And I think it makes a nice companion piece to this post of mine.

ReplyDeletehttp://jazzbumpa.blogspot.com/2011/06/where-has-all-money-gone-part-152-more.html

Financial debt is the debt that is needed to permit the growth of debt of the productive sector. Think of it as an underlying cost.

This is true to the extent that finance serves as a lubricant for real investment. But, when finance becomes too big, too much of its effort is directed toward financial manipulations rather than investment. This causes inflation in financial assets, but disinflation in real assets.

The market value of arcane financial instruments that nobody can rationally value, and few can even understand is many times greater than aggregate global GDP. And nobody seems to care.

Hence, the great stagnation. Finance has gone well past the point where it is a parasite.

Tax and regulate the rentiers. That is the only answer.

JzB

I'm still not sure what a 'rentier' is. "Creditor"?

ReplyDeleteA rentier is a person who lives off income from property or investments.

ReplyDeleteWhat, like a retired person?

ReplyDeleteNo. A person deriving all income from "rents" as opposed to labor. I would not include retired in this class.

ReplyDeleteAs a retired person, I live on pension ans SS. Pension is deferred payment. SS is an annuity that I purchased on the installment plan while working. Neither of these qualifies me as a rentier.

ReplyDeleteRent collection is gaining income from the mere existence of an asset, rather than its productive use.

"Rent" in this sense has been generalized to include income derived from financial activities other than real investment in manufacturing physical plant, equipment, real estate, raw materials, etc.

A rentier collects from a sharecropper, just as a feudal lord collects form a serf.

Financial arbitrage is rent collection.

Etc.

Some of this is necessary. Real capital investment almost always requires debt. the lender is collecting a form of rent.

So rent collection is neither good nor bad, per se. The shift from necessary rent collection to greater and more diverse and abstract rent collection has diverted money away from real investment to things like CDO's.

This is bad in at least two ways: 1) money is diverted from investment; 2) excessive financial speculation leads to bubbles. Both of these things retard economic growth.

Worse yet, it is self-perpetuating. Until there is an even bigger collapse than what we have already experience - and learned nothing from.

http://seekingalpha.com/article/198197-why-derivatives-caused-financial-crisis

Winter is Coming,

JzB