Fiddling while Rome burns

7 July 09 - Today's "Alerts" from Seeking Alpha include this gem:

Krugman vs. Bartlett: A Tale of Two Charts by Kurt Brouwer

The post is a mish-mosh of Brouwer-quoting-Krugman-quoting-Bartlett, with some Brouwer-quoting-Bartlett in the mix. And now I'm skimming that soup.

Brouwer opens with an interesting observation:

Despite the fact that most of the existing economic stimulus program has not yet been implemented, a Nobel laureate economist and New York Times columnist and blogger has been advocating a second government stimulus program.

Yeah, the existing stimulus plan has hardly been implemented at all. As of today -- 140 days since President Obama signed the stimulus bill into law -- only about 7.2% of the $787B has been allocated.

(On the little "Stimulus Watch" gadget my son Jerry created for me, we say 7.2% has been spent. Perhaps that's not quite right. Our number comes from VP Joe Biden's recovery.gov site, where he lists it as the total "paid out." However, that site identifies 10 October '09 as the day that "recipient reporting begins." So I'm thinking the "paid out" number counts money distributed from the big bureaucracy in D.C. to smaller bureaucracies in D.C. and elsewhere, government offices that have been drawing up lists of "shovel-ready" projects. I'm doubting that any of that 7.2% has found its way to people with shovels.)

So yeah, as Brauwer says, it's a "fact that most of the existing economic stimulus program has not yet been implemented." And it is obvious to me that this could be the reason we've seen little effect from the stimulus. Brauwer, however, completely misses the obvious.

He has flies in his eyes: Paul Krugman's comments on Bruce Bartlett's article.

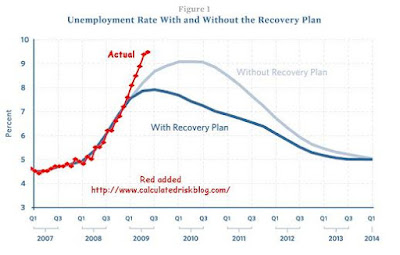

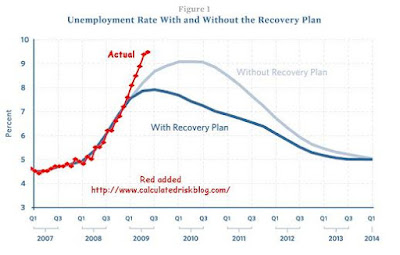

Bartlett says Obama was "much too optimistic" about effects of the stimulus package. He says Obama's economists expected results "almost immediately." And Krugman says "that's totally false." Krugman's evidence is a graph you've likely seen before, showing projected unemployment with, and without, the stimulus.

Now what I see in that graph is a reduction of unemployment projected to begin in the Second Quarter of 2009. I would call that an almost immediate effect of First Quarter activity. So I would say Krugman's evidence shows Bartlett's statement to be true, not false.

But what do I know. Brouwer says "Krugman is quibbling." And then he says, "Wouldn’t it have made sense for Krugman to update the chart to see how much of a positive effect the stimulus program has had?"

Well, no. Krugman didn't post the chart so we could see the most current situation. He posted the chart to prove Bartlett wrong. (It didn't work, but that's another matter.) Looks to me like Brouwer is IM-ing Krugman.

Brauwer has his own agenda. He wants to see the most current results of the stimulus. He wants to see the most current unemployment situation. So, does it make sense for him to post the update?

Well, Idunno. Because it is, as Brauwer says, "fact that most of the existing economic stimulus program has not yet been implemented." But then it might be interesting to look at the results of not implementing the stimulus.

So, Brauwer presents his update. It shows unemployment skyrocketing. Obviously, this recession or depression is a lot worse than we thought, worse than Obama thought, worse than the January predictions.

And then Brauwer says, "At this point, it is clear that the economic stimulus program has not delivered as promised." And he quotes Bartlett: "Another stimulus would be a grave mistake. The first one was justified by extraordinary circumstances. But it must be given time to work. People should not allow their impatience to lead to the adoption of policies...."

Impatience? Give it time to work?? Really??? Unemployment is much worse than expected. Worse than we anticipated when Congress settled on the $787B number. The recession is worse than we thought, when we thought a $787B stimulus would fix it. So the $787B must be too small to fix this recession.

If a stimulus package is the answer, then it must be sufficient to address the problem or there is no bang for the buck, and the money is truly wasted.

The economic stimulus program has not delivered as promised? But how can Brauwer say this? After all, he points out "the fact that most of the existing economic stimulus program has not yet been implemented." So of course it hasn't delivered.

My God! The whole purpose of stimulus spending is to create an immediate surge of economic activity. Immediacy is the essence. One cannot wait while the economy declines further. For then, to achieve the equivalent effect, the surge must be even bigger.

Immediacy is the essence. Allow me to close, as Brauwer closes, by quoting Bruce Bartlett:

…just 11 per cent of the discretionary spending on highways, mass transit, energy efficiency and other programmes involving direct government purchases will have been spent by the end of this fiscal year. Even by the end of 2010 less than half the funds will have been disbursed and by the end of 2011 more than a quarter of the money will be unspent.