A month ago, back at the end of January, my Blogger Preview display suddenly picked up a huge delay. Like, fifty little alligators. It's no longer useable. I griped about it, briefly, figuring it would go away. But it hasn't. I just no longer use it.

Last night I was pretty sad about the passing of Leonard Nimoy. I spent a couple hours reading news articles and looking for an image or two to put up on the blog. Around 8PM I settled on two images, uploaded them to the blog, and posted the thing.

Felt a little better then. (Not much, but a little. It was like mourning-time. I swear, I think Nimoy's passing affected me more than the assassination of JFK.)

Thankfully, Spock lives on.

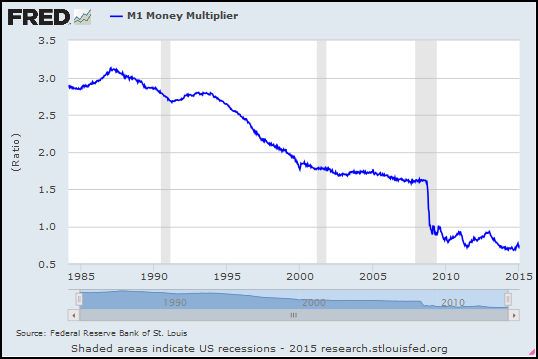

Anyway, this morning between three and four AM -- the puppy has to go out at all hours, so I'm awake -- I came up with an interesting FRED graph. I tried to prepare a new post to display the graph. But I couldn't get the image to load.

Basically, what happened was this: Everything worked, right up until the end when I had to click OK to complete the last step and load the image.

The OK button just wouldn't work. The button depressed and popped back up, but nothing happened.

Of course, the CANCEL button worked fine.

That was four o'clock this morning.

I googled the problem. Somebody had a similar problem a year ago. And, you know, the responses were typical. They want to know what browser you're using, and what operating system, like you're some kind of idiot.

The thing worked at 8PM, and then it didn't work at 4AM. Don't ask me stupid questions. Check to see if somebody was working on the image-upload code, and check to see if they screwed it up. Don't bullshit me.

So I read a bunch of the follow-up comments. And it seemed that maybe if I switched from Firefox to Chrome the problem would go away. Okay.

First I tried "refreshing" Firefox. That was quick and easy and it didn't work. So then I downloaded Chrome. You know: the Google product. You trust Google, right? I did. That was my mistake.

I was just ever so slightly careless playing 20 questions, no I don't want to download this, no I don't want to download that, I just want Chrome. But then there was a message about fixing errors in Windows, and I said yeah, okay. That was my mistake.

That was my mistake

The damned thing wasn't even done loading yet, and I got three flashing windows with warnings about other problems and offers to download other wonderful things.

I shut it down. Pressed the power button and kept it pressed till the thing shut down.

Turned it back on after a minute and started the browser, and those three flashing windows came back again.

I shut it down and started up in Safe Mode. Somehow I remembered pressing F8 gives me safe mode. In safe mode the help came up. It said I could try System Restore. So I clicked it.

After a few moments I clicked it again. Then a window came up that said System Restore is already running. But there was no evidence that System Restore was running. So I didn't know if it was true or if it was Reimage Repair messing with my head. I tried a few more times and got the same message. Then I took the puppy out again.

When I came back, the System Restore window was open. It recommended I guess the most recent restore point, 5 AM this morning, which was from just before a Windows Update. I said Okay. I gave it a few minutes.

When I came back, that friggin Reimage Repair was out of my system. And everything was working -- except, of course, Blogger's image upload thing. So I figured I'd write this story.

Turns out, before I was done writing, the image upload started working again. So that's how you got to see the "Choose a Layout" form above... and that's how you get to see the puppy again:

|

| Lexi naps on the couch |

Oh, and Jesus! Don't trust Chrome and don't trust Google any more. It's a sad day.

Thankfully, Spock lives on.

.PNG)

.PNG)

.PNG)