Those who are too lightly taxed, are not likely to cry out for an increase; and those who are too heavily taxed, are seldom regular in their payments. The public revenue suffers in both ways.

Thursday, November 30, 2017

Say's Law of Taxes

Say's Law of Taxes

Wednesday, November 29, 2017

No, that's not it

No, that's not it

Searching thru Keynes quotes, I found this:

It's not right.

I know what they did. They "fixed" the quote. They pruned the words. They changed the meaning. It's not right. What Keynes actually said was

The difficulty lies, not in the new ideas, but in escaping from the old ones, which ramify, for those brought up as most of us have been, into every corner of our minds.

Keynes was not a philosopher telling us that coming up with an idea is easier than you think. He was an economist, telling us that the particular ideas he was presenting were really rather simple.

The BrainyQuote version bothers me because it suggests that one solution to economic problems is as good as another. That is surely not true. Moreover, we may not have to "develop a new idea" to fix the economy. What we need, Keynes knew, is the right idea.

And it is difficult to find the right idea when one's mind is littered with garbage.

Tuesday, November 28, 2017

What's crucial is to know why growth has been slowing.

What's crucial is to know why growth has been slowing.

I don't know who Boffins is, but The Register back in September reported that Boffins fear we might be running out of ideas.

The opening:

Innovation, fetishized by Silicon Valley companies and celebrated by business boosters, no longer provides the economic jolt it once did.

In order to maintain Moore's Law – by which transistor density doubles every two years or so – it now takes 18 times as many scientists as it did in the 1970s.

That means each researcher's output today is 18 times less effective in terms of generating economic value than it was several decades ago.

In order to maintain Moore's Law – by which transistor density doubles every two years or so – it now takes 18 times as many scientists as it did in the 1970s.

That means each researcher's output today is 18 times less effective in terms of generating economic value than it was several decades ago.

"18 times less". I can stop reading the Boffins article right there. I guess we'll never know who Boffins is -- or, are.

I saw that stat before, the number of scientists required to accommodate Moore's Law, like angels fitting on the head of a pin. Back in September, maybe. Saw it three or four times, under different and apparently unrelated headings. All the sightings reported the same statistic, though not all in such anti-mathematical terms. 18 times less?? For the record, "times" means multiply and "less" means subtract. What are we supposed to do with 18 -- multiply it or subtract it? Eh, forget Boffins.

I am never impressed when an article draws a conclusion from one statistic. But when three or four articles all draw a conclusion from the same statistic, you will find that I am, well, three or four times less impressed.

Do the math.

It's not only

And there is Robert J Gordon, of course, whose mournful soliloquy suggests that faltering innovation is the cause of declining economic growth. Gordon writes of "six headwinds", problems we cannot solve. He seems to think our innovators are plumb out of ideas.

This reminds me of Arnold J. Toynbee's "challenge and response": Civilization faces repeated challenges, but will survive as long as the response to the challenge is adequate. If we're out of ideas, though, our response may turn out to be inadequate. You should be concerned.

The NBER summary of Robert Gordon's view tells us that economic growth "gradually accelerated after 1750, reached a peak in the middle of the 20th century, and has been slowing down since."

If you want to know why growth accelerated, you need to look back to 1750 and before. Some of that history is fascinating stuff. Fascinating, but not crucial.

What's crucial is to know why growth has been slowing. What's crucial is to know the correct response, the response that will allow civilization to survive.

Timothy Taylor asks Will Artificial Intelligence Recharge Economic Growth? He writes:

Of course, the transition to the artificial intelligence economy will have some bumps and some pain, as did the transitions to electrification and the automobile. But the rest of the world is moving ahead. And history teaches that countries which stay near the technology frontier, and face the needed social adjustments and tradeoffs along the way, tend to be far happier with the choice in the long run than countries which hold back.

It's coming anyway, Taylor says. And because he compares it to "electrification and the automobile" I have to think he sees the AI transition as a way to increase economic growth. That makes sense, at least if you think economic growth has lost its "charge" due to a lack of ideas, and that AI is an idea whose time has come.

But if a lack of good ideas is not the problem, then the advance of artificial intelligence may be no better for us than for Sarah Connor and her son John. So maybe we want to spend a little more time thinking about the cause of the decline of growth.

What if we pick the wrong response? I mean, most people say we have to reduce the Federal debt. Some people say we have to increase the Federal debt. And a few people, myself among them, say we have to reduce private debt. All those ideas are out there. Will any of them work?

Toynbee was right. We have to pick the right response, or it's all for naught. What's crucial is to know why growth has been slowing.

Monday, November 27, 2017

J.S. Mill ignores the internal factor

J.S. Mill ignores the internal factor

Keynes quotes J.S. Mill:

What constitutes the means of payment for commodities is simply commodities. Each person’s means of paying for the productions of other people consist of those which he himself possesses. All sellers are inevitably, and by the meaning of the word, buyers. Could we suddenly double the productive powers of the country, we should double the supply of commodities in every market; but we should, by the same stroke, double the purchasing power. Everybody would bring a double demand as well as supply; everybody would be able to buy twice as much, because every one would have twice as much to offer in exchange. [Principles of Political Economy, Book III, Chap. xiv. § 2.]

But we do not exchange commodities for commodities. We exchange commodities for money, and money for commodities.

Does it matter? Yes, because if somebody saves a dollar, it means that someone else will fail to sell a dollar's worth of their commodities. That puts a small wrinkle in Mill's picture of the economy.

As the economy "matures", more and more dollars are saved. Instead of showing one small wrinkle, the economy comes to look like a crumpled ball of waste paper. And at that point, that's about all it is.

Sunday, November 26, 2017

Debt per Dollar, inverted

Debt per Dollar, inverted

One of the graphs I look at all the time is "Debt per Dollar": Total debt, relative to the quantity of circulating money. Total (public and private) debt, because debt has to be serviced. Circulating money, because that's the money used to service debt.

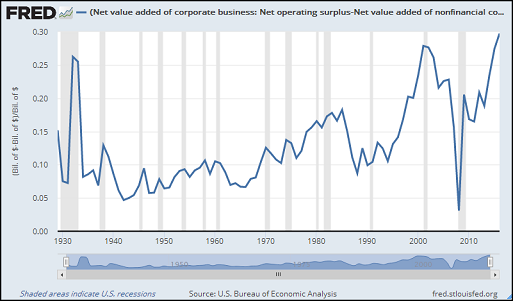

Today for some reason I inverted the ratio. Here is the graph:

|

| Graph #1: The Money We Have for Paying Our Debts (and our other expenses) per Dollar of Debt |

We had about 2 cents of money (per dollar of debt) just before the financial crisis, when the economy was not so good.

Internal factors arose that destroyed the economy. It's right there on the graph.

Saturday, November 25, 2017

Behold: Internal Factors

Behold: Internal Factors

Suppose we have a tiny economy in equilibrium. An economy similar to an early medieval, non-monetary economy. Ten people each producing 12 per year of whatever it is they produce. Each guy takes one of what he produces as his profit, barters nine, and pays the remaining 2 to the lord of the manor as taxes.

This little society can run at that speed forever. You can assume barter conditions that make it fail, of course. But for purposes of equilibrium, we assume barter conditions that make it not fail: Everybody trades one-for-one with nine of his neighbors.

The equilibrium could be upset by an external factor: One guy dies, for example, or a mutant fungus kills his crop. Or somebody revises these sentences.

But there are no internal factors that might arise to destroy the equilibrium. By this I mean the numbers work. Each year 10 people produce 120 things and consume 100 of them, and the lord of the manor consumes the other 20. There are no excesses, no shortages, nothing to upset the apple cart.

We could plug money into this model and it will still work just as well: Each year 10 people produce $120 of things, 10 people consume $100 worth, and one person consumes $20 worth. There are no excesses and no shortages.

But in this case, to make it work, we also have to assume that nobody does any saving. Maybe the lord of the manor is getting fat because he consumes twice as much as everybody else. So he goes on a diet. He decides to save $10 each year, and only consume $10 worth like everybody else.

So now the tiny economy could still produce just as much as ever, but it doesn't, because the people can't afford to buy it all because they don't have the money. Ten dollars disappeared. Ten dollars disappears every year. This can't go on forever. Our little economy will soon run out of money.

You could fix the problem by setting up a system of lending and borrowing. Now it appears that this economy can again go on forever.

But things are going on here that we cannot see. To see them we need more columns in the table. We need a category for accumulated savings and another for accumulated debt. And if our system of lending and borrowing requires that interest be paid, we need a column for that, too.

Everything is fine now, as long as everybody can borrow all they need. They still need to borrow $10 every year to bring consumption up to $120, plus now they need to borrow a little more to cover the interest owed.

But that means people have to borrow more each year than the year before. Before long they will have to borrow more each year than they produce!

And the amount they have to borrow still keeps getting bigger every year. At some point the lord of the manor, the guy with all the savings, decides it's just not worth the risk any more. He says "That's it! No more borrowing! Everybody pay up!" But how can you pay up when you owe $234 and have no savings?

So life as we know it comes to an end.

It is not the "real" economy that's the problem here. Everyone can still produce just as much as before. But they don't, because the equilibrium has collapsed.

The problem is in the money. The money problem crashed the "real" economy.

An internal factor crashed the economy.

Friday, November 24, 2017

Grab a Barf Bag!

Grab a Barf Bag!

Here's a quote that would make Lars Syll retch:

Because DSGE models start from microeconomic principles of constrained decision-making, rather than relying on historical correlations, they are more difficult to solve and analyze. However, because they are also based on the preferences of economic agents, DSGE models offer a natural benchmark for evaluating the effects of policy change.

"... based on the preferences of economic agents, DSGE models offer a natural benchmark for evaluating the effects of policy change.

I think this is one of Syll's pet peeves! DSGE models are not "based on the preferences of" actual economic agents, but on simplified agents arising from "deductivist" assumptions. And, as Syll puts it:

When addressing real economies, the idealizations and abstractions necessary for the deductivist machinery to work simply don’t hold.

I like the MathWorks quote because it is a little bit of evidence that Syll is right. I have no idea who might be right about such things until I see a few bits of evidence like that.

I also like the MathWorks quote because it describes the alternative to DSGE models as "relying on historical correlations", which is the thing that makes sense to me.

// see also: Lucas critique?

// see also: Rethinking the same damn thought

Thursday, November 23, 2017

Sources of Income 1929-2016

Sources of Income 1929-2016

|

| Stacked FRED Graph showing Relative Shares of Income since 1929 |

| Top to bottom: | Interest income |

| Dividends | |

| Rental Income | |

| Proprietor's income | |

| Transfers | |

| Compensation of Employees |

Source: FRED Table 2.1. Personal Income and Its Disposition: Annual

Wednesday, November 22, 2017

Hey Tom

Hey Tom

Remember when I said

I predict a boom of "golden age" vigor, beginning in 2016 and lasting eight to ten years. It has already begun. In two years everyone will be predicting it.

Tom, you said

Art goes out on the limb.

Remember? That was 19, almost 20 months ago. Have you noticed that the mood is more upbeat now? Rather than predicting recession, people seem to think we can get 3% growth.

We'll beat 3%.

Tuesday, November 21, 2017

Six years ago at Asymptosis...

Six years ago at Asymptosis...

Concise, clear, and correct:

Ultimately, of course, private debt and interest charges on that debt needs to be paid off from real-economy income. Asset prices can’t rise forever.

Economists will tell you that gross debt levels don’t matter because one person’s debt is another’s holdings. (Net: zero.) They ignore it.

But if the gross private debt is too large, the real assets in the real economy can’t generate enough income to pay it off. Not really complicated, conceptually.

Economists will tell you that gross debt levels don’t matter because one person’s debt is another’s holdings. (Net: zero.) They ignore it.

But if the gross private debt is too large, the real assets in the real economy can’t generate enough income to pay it off. Not really complicated, conceptually.

Monday, November 20, 2017

The return and maintenance of economic vigor

The return and maintenance of economic vigor

I started predicting vigor in March of 2016. Then in July 2016 I showed a graph of Household Debt Service Payments at a low point and ready to rise:

I called vigor because financial costs are down:

Financial costs have fallen from 13% to 10% of Disposable Personal Income. And now consumers have 3% of DPI to play with. Look at the extreme right end of the blue line on the graph: The line is starting to go up again. Already.

|

| Graph #4: The Fall and Rise of Household Debt Service Payments |

In March I said "We are at the bottom now, ready to go up." Four months later I showed it going up. Debt service is starting to go up again already, I said.

But then, a year after my original prediction of vigor, commenting in March 2017 on the graph shown above, I said

The uptick at the end of Graph #4 seems to have fizzled out. The link shows TDSP thru the end of 2016: https://fred.stlouisfed.org/graph/?g=db7Y

Unfortunately, I wasn't clever enough to capture the graph as an image, and TDSP has since changed. The link in my comment doesn't show what I was looking at in March of 2017, which was something like the red line here:

|

| Graph #1: Household Debt Service as of March 2016 (blue) and March 2017 (red) |

When I looked just now at the graph linked in my March comment, it was the current version. The data had been revised, and the flat end was gone. Debt service is rising again. It is struggling to rise (as you might expect following a debt crisis, while people remain cautious) but it is rising. I marked up an interesting similarity:

|

| Graph #2: Household Debt Service as of October 6 2017 |

I expect what happens after the second tiny maximum will look a lot like what happened after the first: uptrend, a sign of economic vigor. And since the more recent major decline is much bigger, I expect the uptrend will also be bigger this time. We will see economic vigor again, for perhaps a decade.

All that remains is for us to take advantage of the good years: Use the time to prevent another decade of bad years. All we need to do is limit debt growth to something sustainable. Better yet, we should seek the debt-to-GDP ratio that's most conducive to growth. We want to be like a surfer riding a wave of debt, where the wave carries us forward at speed but does not grow to the size of a mountain.

It can be done. To have a vigorous economy, we need lots of borrowing (and that day is coming). But lots of borrowing creates lots of debt. The obvious solution is to pay down debt: to pay down debt faster than we have done in the past. We need policy to make that happen.

Accelerating the repayment of debt may slow the economy some. But so does raising interest rates. We can use accelerated repayment of debt as an anti-inflation policy, along with the interest rate hikes that policymakers already rely on. If accelerated repayment is used, rate hikes will be needed less. And debt will be lower.

But there is something else: Raising interest rates affects all new borrowing, and that curtails economic growth. That's not the best outcome. Accelerated repayment of debt, on the other hand, affects people who have already borrowed. It only slows the economy for those people. People planning to borrow are not hindered by this new approach to inflation control, so economic growth is less severely reduced.

The new policy has to allow for the fact that we're starting with a high level of debt. It must reduce debt gradually, so that people are not thrown into crisis by it. That may seem to defeat the purpose, but it does not. As long as debt is going down, we're on the right track. And almost immediately after the level of debt begins to fall, the economy will begin to improve.

We never had policy that accelerates the repayment of debt. That's the reason private debt got so big. We have lots of policies that encourage the use of credit, and none to encourage repayment. To make policy more balanced, more sensible, we need policies that accelerate the repayment of debt. This way we can keep policies that encourage credit use (and enjoy the growth that results from those policies) but avoid having debt grow to an unsustainable level.

We still do have a mountain of debt to deal with. Some people might worry that "accelerated repayment" would make life difficult for debtors. But there is no reason the policy should be punitive. At the start, the new policy must help us reduce our debt: It must not be punitive. Once debt falls back to a level that is compatible with a vigorous economy (and stabilizes there) the policy can be made neutral. It need never be punitive.

Sunday, November 19, 2017

Financial Cost (4): F over N

Financial Cost (4): F over N

Table 1.14 shows "Gross value added of corporate business" along with a list of the component parts of GVA. The table also shows GVA of "financial corporate business" and of "nonfinancial corporate business". There's no list of components for financial corporate, but there is one for nonfinancial corporate.

Add financial and nonfinancial GVA together on a graph, and they completely cover over the "corporate business" GVA. It's a near perfect match. So I'm thinking I can take the "corporate business" component list and subtract the "nonfinancial corporate" component values, and this will give me the "financial" components. Then I can compare the financial and nonfinancial corporate data.

I'll remind you that what they call "nonfinancial" I call "productive" business, and that what they call "financial" I call "nonproductive". For some reason, they put financial ahead of nonfinancial in Table 1.14. I'd put them the other way around, and use my labels. I guess it depends what you think is more important.

Here's financial-relative-to-nonfinancial GVA (red) nicely centered on corporate-minus-nonfinancial-relative-to-nonfinancial GVA (blue):

|

| Graph #1: Financial GVA relative to Nonfinancial GVA |

| CE | Compensation of Employees |

| OS | Operating Surplus |

| GVA | Gross Value Added |

So, for example, the above graph is abbreviated as FGVA/NGVA, the ratio of financial to nonfinancial Gross Value Added.

For Compensation of Employees, financial gained on nonfinancial from 1945 to 1980, and then gained on it even faster:

|

| Graph #2: Compensation of Employees, Financial relative to Nonfinancial: FCE/NCE |

In part (3) of this series of posts I had in mind to subtract net interest from corporate profits, but I found out that net interest is not included in corporate profits, so I threw that idea away. For the graph below, I went the other way: I used Operating Surplus, which is profits plus net interest plus some other thing.

|

| Graph #3: Operating Surplus, Financial relative to Nonfinancial: FOS/NOS |

I noticed that coming out of WWII, compensation of employees (Graph #2) increases from 0.04 to something over 12 by the end of the graph. But the operating surplus (Graph #3) increases to maybe 25 by the end. I got the impression that the operating surplus (net interest and profit) is increasing quite a bit faster than employee compensation.

Is it? Look at the CE ratio relative to the OS ratio, Graph #2 divided by Graph #3:

|

| Graph #4: Compensation of Employees F/N Ratio relative to Operating Surplus F/N Ratio (FCE/NCE)/(FOS/NOS) |

So I'm left thinking that the problem, if one is visible in this data, the problem is not found in the increase of profit and interest relative to employee compensation. Rather, the problem would have to be in the growth of corporate finance in general, relative to nonfinancial corporate business. That problem is clearly visible in Graph #1.

// The Excel file

Labels:

Financial Cost

Saturday, November 18, 2017

Financial Cost (3), aborted

Financial Cost (3), aborted

I want to take "net interest" out of corporate profits, and compare what's left to "gross" interest paid.

If you look at National income: Domestic business: Corporate business: Compensation of employees at FRED, down near the bottom of the page they show RELEASE TABLES. Clicking the link for Table 1.14 brings up a page that identifies the hierarchy of components of "Gross Value Added of Domestic Corporate Business in Current Dollars".

The table shows that net interest is not counted in corporate profits. So then, I don't have to subtract it out.

Labels:

Financial Cost

Friday, November 17, 2017

Financial Cost (2): Inspection

Financial Cost (2): Inspection

I want to use GVA (gross value added) as the context for profits and interest expense. Better than GDP in this case, I think, because the GVA I'm using is "Gross value added of corporate business". The Financial Times lexicon says

GDP is commonly estimated using one of three theoretical approaches: production, income or expenditure. When using production or income approaches, the contribution to an economy of a particular industry or sector is measured using GVA.

So the GVA number I'm using measures the part of GDP produced by corporate business. I think that's a good context number for corporate profits and corporate interest expense.

The data I downloaded for mine of the 12th (the data I'm using here) includes GDP and RGDP. (From these I can get price deflator values if needed.) Also: interest paid and compensation of employees for "domestic corporate business"; GVA for "corporate business"; and "corporate" profits. I'm pretty sure these data series (except GDP and RGDP) are all numbers for "domestic corporate business", but I don't know for sure. If you know something I don't, let me know.

First graph shows employee compensation, monetary interest paid, and corporate profit, each as a percent of corporate GVA:

|

| Graph #1: |

Employee compensation (blue) as a share of corporate GVA runs pretty stable (more stable than Labor Share, which seems to show decline since 1960), running above 60% until the year 2000, when it starts to drop.

Corporate profits (green) decline from about 25% of corporate GVA to just over 10%. They run low in the Reagan years (interesting!) but pick up a bit in the latter 1990s, then start rising just as labor share starts to drop. Profits are now running above 20% again.

Total corporate Interest paid (red) is shown as a percent of GVA for purposes of comparison. Interest starts out low, less than 2.5% of corporate GVA, but rises to 10% by 1970. It peaks at 27.4% of GVA in 1982, runs high while corporate profits run low (the Reagan years), and peaks at 28.5% in 1989. Thereafter, the trend is slowly downward, but with increasing volatility.

It appears that interest gained at the expense of profits in the 1980s, and that after 2000 profits gained on employee compensation ("labor"). For what that's worth.

To see the relative changes in the three series on the first graph, I divided each series by its 1947 value so all three series start with the value 1.0:

|

| Graph #2: |

The first graph emphasized the different sizes of the three data series. The second emphasizes the changes in size. The red line really stands out here, but the extreme flatness of the blue is equally noteworthy.

I took profits and employee compensation from Graph #1, and subtracted them from total corporate GVA to see how much of GVA remains for other corporate spending. That's the blue line here:

|

| Graph #3: |

"Interest paid" is a big number. Big, and mostly unnecessary.

Labels:

Financial Cost

Thursday, November 16, 2017

Financial Cost (1): Overview of the data

Financial Cost (1): Overview of the data

This graph shows "percent change" rates for the data downloaded for my post of 12 November. Annual data, so the graph shows "percent change from prior year".

The first tall spike we come to, above 40%, between 1948 and 1952, that yucky blue line shows corporate profits. Corporate profits are pretty volatile: The line peaks repeatedly, both upward and downward, and this behavior is consistent for the whole 1948-2016 period shown on the graph.

That volatility is the reason I'm doing this follow-up to mine of the 12th. In that post I looked at corporate data for 1955 through 1958, a brief period during which the growth of profits began by increasing 26% over the previous year, and ended by falling 12% below the previous year.

Those growth rates suggest that corporate profits were well above trend in '55 and well below trend in '58. I wasn't thinking about that when I wrote the post. I was working with those years because those were the years Samuelson and Solow considered in particular in their 1960 paper.

The differences from trend no doubt exaggerated the movements of my "interest cost relative to profits" ratio, giving me the ten-point increase in interest cost (from 15% to 25%) relative to profits. So I'm thinking my numbers exaggerated the situation, perhaps significantly. That's why I'm taking another look.

After the yucky blue line, the red line stands out as also highly volatile. That's the interest cost. This one shows more variation than do profits, across the whole 1948-2016 period. The red line is pretty tame before the mid-1960s, staying generally between 10% and 20%. Then from the mid-1960s to the early 1980s the red peaks grow increasingly higher, and the down-pointing peaks increasingly lower. The growing volatility in this period likely reflects the inflation of the time. Finally, since the mid-1980s the red line seems to show some increase over time, but I'd say the main feature is that the movements here are very much bigger than those before the mid-1960s. They are about equal in size to movements during the 1970s and early '80s, but run lower: During the Great Inflation the red line didn't want to go below zero; since the mid-80s it has been centered on the zero level.

The next line that catches my eye is the gold one, Corporate Gross Value Added (GVA). This line shows little volatility, little vertical motion. It's chief function on this graph seems to be to hide the other lines that display little volatility: nominal GDP (purple) and Employee Compensation (dark blue).

The one line so far omitted from my review of the graph is the greenish line, which shows the growth of GDP with inflation removed from the numbers. This line is mostly hidden by the gold line, except during the years from the mid-1960s to the early 1980s. Again, this is the time of the so-called Great Inflation so we should expect to see the green line run low in these years. And the fact that it does run low supports the view that the growing volatility of the red line in those years "reflects the inflation of the time.

Notice that the gold line and the lines that it hides show a hint of uptrend during the years of inflation. This isn't news. But I want to mention it now so that maybe I won't be fooled by it when I'm lost in the details of my analysis of the numbers.

Labels:

Financial Cost

Sunday, November 12, 2017

Comparative advantage, economies of scale, and the cost of finance

Comparative advantage, economies of scale, and the cost of finance

Paul Krugman has an old paper titled How I Work which might be worth your time to read. I want to repeat a fragment of it here, for my own purposes. Krugman writes of his early days as an economist:

What had I found? The point of my trade models was not particularly startling once one thought about it: economies of scale could be an independent cause of international trade, even in the absence of comparative advantage. This was a new insight to me ...

"... within a few days," Krugman says, "I realized that I had hold of something that would form the core of my professional life." It was important to him, this little fragment which said not only comparative advantage, but also economies of scale drive international trade. It was important to him for personal reasons.

It is important to me because I read it this way:

not only comparative advantage, but other things also drive international trade.

It is important to me because it opens a door, the other things also door. And I know what I must bring through that door: the cost of finance.

That shouldn't surprise you. I always look at things in terms of the cost of finance.

Conservatives always gripe about the cost of labor. Liberals always grumble about profits. To my mind you need both wages and profits, if you are to have an economy. And, certainly, you also need finance.

But how much finance do you need? These days, we need a lot. Or, as I see it, we don't really need a lot of finance, but we sure do have a lot. And because we have a lot of finance, the cost of finance is high.

No, not just the rate of interest. Rather, the rate of interest applied to every dollar of debt. If there is not much debt, the cost of finance is low. If there is a lot of debt the cost of finance can be high, even when interest rates are low.

On the consumption side, the cost of finance reduces aggregate demand. On the production side, the cost of finance reduces profits and increases prices. A high cost of finance reduces demand and profits, both, and creates an economy in decline, the kind of decline we have endured now for decades. The cost of finance is a crucial consideration. That's why I talk about it all the time. But set all that aside.

In addition to reducing demand and reducing profits, the cost of finance also adds to the cost of products. It contributes to the increase of prices. (And this does not consider the effect finance has on the quantity of money, and the "inflation is always a monetary phenomenon" thing. But set that phenomenon aside.)

When the cost of finance is rising, it increases costs. It makes output more costly.

In Krugman's "How I Work" paper he says he doesn't worry that his assumptions might be unrealistic. He worries about not knowing what his assumptions are. There are some problems with that approach, but I'll go with it for now. I'll assume that the level of finance was at its best around 1955. You might think 1955 is an unrealistic date. I think it's not far off. But if it makes the reading easier, you can assume I picked a more reasonable date -- still decades ago, but not so many decades ago. That would make the latter 1950s a premonition of what was to come. I can live with that.

By "the level of finance was at its best" I mean that when finance was less, it hindered economic growth more, and that when finance was more it also hindered growth more. I imagine something like a "Laffer curve" for the optimum size of finance. If my Laffer curve comparison doesn't make sense to you, don't worry about it.

In 1960, looking back at the latter 1950s, Samuelson and Solow wrote:

... just by the time that cost-push was becoming discredited as a theory of inflation, we ran into the rather puzzling phenomenon of the 1955-58 upward creep of prices, which seemed to take place in the last part of the period despite growing overcapacity, slack labor markets, slow real growth, and no apparent great buoyancy in over-all demand.

In the end, Samuelson and Solow could not reject the cost-push explanation:

We have concluded that it is not possible on the basis of a priori reasoning to reject either the demand-pull or cost-push hypothesis ...

Ten years later, Federal Reserve Chairman Arthur Burns was pointing to the increases in employee compensation as the driver of inflation. Robert Hetzel quotes from the Board of Governors Minutes for November 1970, that Burns thought in terms of "cost-push inflation generated by union demands."

Perhaps by 1970 union demands were driving inflation. But in the latter 1950s? In the latter 1950s, the rising cost of finance was squeezing profits.

Growing financial cost got the inflation ball rolling. Union demands took the hit for it later, and perhaps rightly so. But union demands did not create the initial problem. The rising cost of finance got inflation going, and kept it going until a wage-price spiral emerged.

For domestic corporate business, financial cost increased faster than the compensation of employees:

|

| Graph #1: Interest Costs Increased Faster Than Compensation of Employees |

Financial costs also gained on profits:

|

| Graph #2: Interest Costs Increased Faster Than Corporate Profits |

If financial costs had grown more slowly, if they had grown at the same rate as profits, say, how would the world have been different?

In 1955, corporate business interest paid totaled $7.3 billion, something less that 15% of profits. In 1958, interest paid came to $11.4 billion, something more than 25% of profits. Other things unchanged, if interest paid in 1958 remained at the 1955 percentage, the cost of interest would have been about $6.4 billion. This is $5 billion less than the actual 1958 cost of interest.

If this $5 billion expenditure had not happened, other things unchanged, corporate profits would have been $5 billion higher.

But I can't add that $5 billion to corporate profit, because it changes my interest-to-profit ratio. It throws the calculation off. In order to work thru the calculation cleanly, we cannot add the $5 billion of interest savings to corporate profits, nor to any corporate spending category. The only way to dispose of the $5 billion is to reduce gross corporate revenue by reducing the price of the corporate product.

In 1958, the gross value added (GVA) to the economy by corporate business amounted to $256.9 billion. If we reduce the price of GVA by $5 billion, the reduced number is $251.9 billion. The reduced GVA number is 98% of the actual number. So, to make the calculation work we have to reduce the price of corporate output by 2%.

If corporate interest costs in 1958 remained in the same proportions as 1955, corporations could have reduced their prices by 2% without reducing their profits and without reducing the wages and benefits paid to their employees. Without reducing any of their spending, other than interest.

This is an exercise in "other things unchanged". Ceteris paribus. The assumption is not realistic. But the numbers tell an honest tale: The cost of interest increased faster than other corporate business costs, fast enough to push prices up 2% between 1955 and 1958.

This suggests a different conclusion for the Samuelson-Solow paper: identification of cost-push as the cause of the 1955-1958 inflation.

How did the rising cost of finance affect the economy?

In 1962, President Kennedy was "jawboning" the steel companies, trying to talk them out of raising prices. They raised prices anyway. In response then,

Kennedy launched investigations by the FTC and Justice Department into collusion and price rigging by the steel companies [and] threatened to break Pentagon contracts with U.S. Steel.

The steel companies acquiesced, rolling back the price hike. But they raised prices anyway the following year. This cannot have been simply

a tiny handful of steel executives whose pursuit of private power and profit exceeds their sense of public responsibility

as Kennedy claimed. The price increase was driven by financial cost pressures that Kennedy could not see. "Operating cost" pressures, according to encyclopedia.com:

Profits were being squeezed between rising operating costs and relatively stable prices, and in April 1962 U.S. Steel unexpectedly announced an across-the-board price increase ...

Kennedy was looking for a wage-price spiral. The steel price hike was not part of a wage-price spiral. In March of 1962 the Steelworkers accepted a contract that gave them no wage increase. In April, the price of steel increased 3.5%. The source of the cost pressure was not labor, but finance.

In 1965, on the last day of the year, in its renowned We Are All Keynesians Now article, Time magazine wrote:

First the U.S. economists embraced Keynesianism, then the public accepted its tenets. Now even businessmen, traditionally hostile to Government's role in the economy, have been won over—not only because Keynesianism works but because Lyndon Johnson knows how to make it palatable. They have begun to take for granted that the Government will intervene to head off recession or choke off inflation, no longer think that deficit spending is immoral. Nor, in perhaps the greatest change of all, do they believe that Government will ever fully pay off its debt, any more than General Motors or IBM find it advisable to pay off their long-term obligations; instead of demanding payment, creditors would rather continue collecting interest.

The "greatest change of all" was acceptance of the view that government would act more like business, rolling debt over rather than paying it off.

That change didn't last. Already in 1964, Ronald Reagan had spoken on behalf of Presidential candidate Barry Goldwater. Reagan:

Today, 37 cents of every dollar earned in this country is the tax collector's share, and yet our government continues to spend $17 million a day more than the government takes in. We haven't balanced our budget 28 out of the last 34 years. We have raised our debt limit three times in the last twelve months ...

In 1980, Reagan himself was elected President in a landslide. "We don’t have a trillion-dollar debt because we haven’t taxed enough," he said; "we have a trillion-dollar debt because we spend too much." By 1980, the greatest change of all was that people had come to believe the Federal debt must be reduced. So much for being all Keynesian.

But notice what was not a change in 1965: businesses did not "find it advisable to pay off their long-term obligations". Accumulating debt was standard practice. For the longest time, people thought it was okay if private debt increased. I guess that did finally change, about ten years back. But here's the thing: Corporate interest costs ran neck-and-neck with profits in 2003-2005. Other than that, interest costs were higher than corporate profits from 1980 to the crisis.

Corporate business interest costs were only 15% as much as profits in 1955. By 1980, interest costs were more than profits. The growth of financial cost, a trend visible in the late 1950s, continued to 1980 and continued on to the crisis.

By 1970 one could easily see that wage hikes were driving inflation, because employee compensation is a far larger number than the cost of interest. And by 1970, everyone was trying to catch up with everyone else. Inflation had become self-sustaining. But how, in the latter 1950s, with "no apparent great buoyancy in over-all demand", how is "the 1955-58 upward creep of prices" to be explained? And then in the early 1960s, the price of steel? These were not stories of demand-pull inflation. They were cost-push stories. But the driving force was not compensation of employees or union demands or wages. The driving force was rising financial cost.

"Comparative advantage" makes some domestic products an international bargain, and this, as Paul Krugman writes, is a "cause of international trade". But the point of Krugman's trade models was to show that economies of scale can also make some products a bargain in foreign markets. The lesson we learn from Paul Krugman is that costs affect trade: Low costs increase trade. High costs reduce it.

In the US we rely on credit. Credit has a cost. The use of credit in the productive sector raises the prices of US products. If we rely more on credit than other nations, our financial costs will be higher than theirs. Those costs are reflected in the higher prices of our products. High prices make our products less competitive in international markets.

Increasing financial costs, by raising prices, may be to blame for a significant share of US trade deficits going all the way back to the 1970s.

The point of this essay is not particularly startling once one thinks about it: Despite the best comparative advantage and the greatest economies of scale, high financial costs can be an impediment to the export trade.

// The Excel file

Labels:

Financial Cost

Saturday, November 11, 2017

What was it that got the wage-price spiral started?

What was it that got the wage-price spiral started?

It had to be something other than the wage-price spiral.

What was the initial shock that started the Great Inflation? In Ronald Reagan and the Politics of Freedom, Andrew E. Busch says what everybody thinks -- it started with a wage-price spiral:

I disagree. There had to be some other "push" that got things started.

Wikipedia:

In macroeconomics, the price/wage spiral (also called the wage/price spiral or wage-price spiral) represents a vicious circle process in which wage increases cause price increases which in turn cause wage increases, possibly with no answer to which came first.

This is totally unsatisfactory!

From InvestingAnswers:

The general idea behind a wage-price spiral is a simple one of supply and demand. People can do only two things with money: save it or spend it. If they have more money on hand, they likely will spend at least some of that money. Accordingly, putting more money in people's hands creates more demand for goods and services. Thus, something like a wage increase across the board (think, for example, of a rise in the minimum wage) creates more demand for goods and services and drives up the prices of those goods and services.

So the Minimum Wage caused the Great Inflation? No.

From Chron:

When an economy is operating at near full employment and people have money to spend, demand for goods and services increases. To meet the demand, companies expand their businesses and hire more workers. However, at near full employment, most workers already have jobs. So companies have to lure workers with higher wages, which, of course, increases the companies' costs, explains the website Biz/ed. The workers then push for higher wages to meet the higher prices and expected price hikes, which increases company costs again. Theoretically, this continues in an inflationary spiral until a loaf of bread costs the proverbial wheelbarrow full of cash.

Full employment creates a wage-price spiral? That sounds reasonable...

So they're saying the 1965-1971 spike in employee compensation (relative to GDP) is what got the wage-price spiral going. But most of that spike occurred after the Great Inflation was already under way! And the other spikes, did they also cause wage-price spirals that led to Great Inflations?

And what about the 1960-65 decline in employee compensation? Prices were going up then, too. "Full employment" may be a plausible story of the Great Inflation, but it doesn't seem to explain how the wage-price spiral got started.

Labels:

Financial Cost

Thursday, November 9, 2017

David "Dirtbag" Ricardo

David "Dirtbag" Ricardo

Wikipedia on David Ricardo:

He made the bulk of his fortune as a result of speculation on the outcome of the Battle of Waterloo. Prior to the battle, Ricardo posted an observer to convey early results of the outcome. He then deliberately created the mistaken impression the French had won by initially openly selling British securities. A market panic ensued. Following this panic he moved to buy British securities at a steep discount. The Sunday Times reported in Ricardo’s obituary, published on 14 September 1823, that during the Battle of Waterloo Ricardo "netted upwards of a million sterling", a huge sum at the time. He immediately retired, his position on the floor no longer tenable ...

In August 1818 he bought Lord Portarlington’s seat in Parliament for £4,000 ...

Wednesday, November 8, 2017

Slowly, people are recognizing that the economy is improving

Slowly, people are recognizing that the economy is improving

30 Aug 2017: Trump's hope for 3% growth no longer looks so far-fetched at CNBC:

When President Donald Trump predicted that his policies would spur growth of 3 percent or more, a lot of economists didn't take him seriously. They may now.

...

"It's not just the GDP report. We've had a really steady stream lately, whether it's GDP or ADP or [jobless] claims or retail sales or confidence measures," said Jim Paulsen, chief investment strategist at the Leuthold Group.

8 Sept 2017: Two signs the US economy really is getting better, from World Economic Forum:

Forget the soaring stock market. Here's the real evidence the U.S. economy is getting better: Food stamp usage is down, and spending on entertainment — everything from Netflix to Disney World trips — is up.

27 October 2017: US economy on solid growth path from dw.com:

The world's largest economy has seen its total output expand by a rate that the US President had expected to see because of his tax and investment policy. But for all of 2017, the rate will be hard to maintain.

...

For all of 2017, forecasters believe the economy will grow at an annual rate of around 2.2 percent, rising to 2.4 percent next year.

Tuesday, November 7, 2017

The world is not digital

The world is not digital

In a digital world, economic growth would look something like this:

But our world is not digital. Economic growth looks like this:

In our world it is difficult to tell what will happen next. In a digital world, it is true, the bottom could drop out at any time. But until it did, at least you would know whether your economy was "good" or not. Those would be the only choices in a digital world: It's good, or it's not good.

A digital world might offer a high level of confidence about the future. Our world offers only a low level of confidence about the future. Nevertheless, I confidently predict a good decade for the US economy. Where does my confidence come from, and why isn't everyone making similar predictions?

There are a couple different ways of looking at the economy. One way is to grab the most current data announcements you can find, because the most current announcements are nearest to what we want to know about: the future.

It's not a perfect method, because it doesn't really give you the future. But it does give you the closest thing.

The trouble with this method is that the world is not digital. The most current data announcements are up today and down tomorrow. Current data is all over the place. So you have to filter the facts, or prioritize the information, or assign weights to the data to determine what you think the future will look like.

The other way to look at the economy is to focus on everything but the most current data. Don't worry about the last ten minutes or (in this case) the last ten years. Focus instead on a lifetime of years before that. Look for patterns in that data. Give some weight to existing knowledge, and give almost as much weight to "heterodox" views, but always put the most emphasis on what you can see for yourself.

In Current GDP Growth Isn't Anything Special, Justin Fox is trying to see the future. He relies on the most current data announcements:

Real gross domestic product has now grown at an estimated annual rate of 3 percent or more in the U.S. for two quarters in a row (3 percent in the third quarter, 3.1 percent in the second).

"... but two quarters don't tell us much," he says. Fox reminds us that quarterly data is volatile and noisy. He considers looking at the 12-month change rather than one or two 3-month changes. That smooths things out a bit. And the longer wait provides more solid evidence. But when things finally do start getting better, you have to wait a year to get your evidence! And as Justin Fox says, "looking back four quarters is, well, backward-looking." It tells you about the past, not the future.

Fox has another thought: Look at different data, something less volatile than GDP. He references a 2015 study that uses "real final sales to private domestic purchasers". He looks at the most recent data for this series, and he writes:

By that metric, economic growth in the third quarter was just OK, at 2.2 percent... But there's really no sign from the GDP data yet that the slow-growth era is ending.

There might be a sign that the slow-growth era is ending. Those two most recent quarters of GDP growth might be a sign. We won't know for sure until the evidence is solid. But by the time the evidence is solid the improvement won't be news anymore. People want to know now. And if you have reasons for thinking that the economy is improving now, you want to talk about it now, not a year from now.

This goes back to the question that got me writing today: How can we know before it happens that the economy is improving?

Not by tracking the most recent data. You know it by studying the past until you think you understand how the economy behaves. After that, you start watching the recent data, looking for patterns that mimic patterns you've seen in the past. When you find those patterns, you make your prediction about the economy. Then you wait and see.

Recently I've been pointing out the most recent data myself: better productivity here, improved growth here and here. Upbeat data like that is not evidence; not yet. It will be, when there is enough of it. I point out such data to remind you of my prediction that our economy will soon be "good" for about a decade. Because in the context of my prediction, that data is evidence.

Hey, I could be wrong about the economy improving. But here's the thing. If I'm not wrong, then maybe the patterns I've found in the old data are significant. Maybe those patterns describe an area of study that economists ought to include in their work: Accumulated debt relative to the quantity of circulating money. Private debt relative to public debt. Debt service relative to income. Things like that. Today, economists nibble around the edges of such concepts, or miss them entirely.

That's why I so often bring up my prediction of a decade of vigor.

How do you predict the future? You want to look at what is sometimes called "fundamentals". Nobody ever defines fundamentals, of course. They only say the fundamentals are sound when they're telling us not to worry about some worrisome thing. But I'll tell you what "fundamentals" is, what my idea of it is: it is the cost of finance in comparison to the cost of labor and profit. And I'll tell you how it works: If the cost of finance is low, the economy can grow, and if the cost of finance is rising, the economy is growing. But if the cost of finance is high, there can be no vigor.

Monday, November 6, 2017

A psalm of balance

A psalm of balance

The use of credit gives the economy a boost, but also creates debt which eventually undermines the "boost" effect.

Policymakers are well aware that the use of credit boosts the economy. They create all sorts of policies to encourage the use of credit: deductible interest expense, financial deregulation, low interest rates and quantitative easing, for example.

Except in times of crisis, these policies cause the use of credit to grow at an accelerated rate. Therefore, debt ordinarily grows at an accelerated rate.

We have no policy designed to accelerate the repayment of debt. Therefore, debt grows at an accelerated rate until it accumulates enough to create a crisis.

If we insist on having policies that encourage the use of credit, then we must also have policies that accelerate the repayment of private debt.

Sunday, November 5, 2017

Shitting on the Cato guy

Shitting on the Cato guy

From Cato: Labor’s Share of GDP: Wrong Answers to a Wrong Question by Alan Reynolds.

The opening paragraph:

A recent paper by David Autor of MIT, Lawrence Katz of Harvard and others, “The Fall of the Labor Share and the Rise of Superstar Firms,” begins by posing a mystery: “The fall of labor’s share of GDP in the United States and many other countries in recent decades is well documented but its causes remain uncertain.” They construct a model to blame it on U.S. businesses that are too successful with consumers.

"They construct a model to blame it on U.S. businesses that are too successful with consumers." The writing reeks of attitude. Attitude often makes for a good read, but it seldom makes for a good argument.

I'm interested because I have trouble understanding what "labor share" represents. I mean, at FRED, Labor Share for the business sector, and also for the nonfarm business sector, are shown as indexes, not as percent of GDP. I can guess that the indexes show changes in labor share as a percent of GDP over time, yes, but I can't tell what the percent values actually are.

There is a "Share of Labour Compensation in GDP" series with "ratio" units. It's a simple thing to get "percent" values from that one. And the overall trend of this series is like the others: downhill. But at a slightly closer glance it doesn't really match either of the "labor share" series. So I'm left hanging. I thought maybe the Cato article would help.

Heh.

Second paragraph:

Five broad industries, they found, became more dominated by fewer firms between 1982 and 2012: retailing, finance, wholesaling, manufacturing and services. But those aren’t industries at all, much less relevant markets: they’re gigantic, diverse sectors. Is all manufacturing becoming monopolized? Really? Census data ignores imports, but why ruin this bad story with good facts.

So the guy is complaining that Autor and Katz left out the word sectors? Because they said "industries" instead of "industrial sectors"? Really?

And again, attitude: Five gigantic, diverse sectors became more dominated by fewer firms, "but why ruin this bad story with good facts."

At last, in the third paragraph, a possibly useful observation:

Jason Furman and Peter Orszag found “the decline in the labor share of income is not due to an increase in the share of income going to productive capital—which has largely been stable—but instead is due to the increased share of income going to housing capital.”

The useful observation is Orszag and Furman's, not Cato's, but at least the Cato guy provides a link.

In paragraph four, Cato guy is complaining about "industries" versus "industrial sectors" again:

President Obama’s Council of Economic Advisers, under Jason Furman, nonetheless worried that the 50 [!] largest firms in just 10 “industries” (if you can imagine retailing and real estate to be industries) had a larger share of sales in 2012 than in 1997 ...

But yeah, I can imagine retailing and real estate as industries. Cato guy is being ridiculous. Finally, in the rest of paragraph four, he moves on to a different complaint:

They concluded that, “many industries may be becoming more concentrated.” Noah Smith, Paul Krugman and many others have suggested that this nebulous “concentration” allowed monopoly profits to rise at the expense of the working class, supposedly explaining labor’s falling share of GDP during the high-tech boom. A quixotic search for even one actual example of monopoly soon morphed into advice about using unconstrained antitrust to constrain Amazon, which is apparently feared to have monopoly profits invisible to the rest of us.

Now he cannot see the boom in corporate consolidation, and cannot figure out why monopoly might be a problem. And look what he does there at the end: "Invisible to the rest of us," he says. Cato guy takes us, his readers, and imagines we stand with him, blind to the monopoly profits that may or may not exist in the one particular place where my wife does all her shopping: Prime.

But forget that Cato crap about "invisible" profits which are "apparently feared" by some unidentified but obviously stupid bunch of people. Forget that. I'll tell you what really bothers me about Amazon. And it's not the so-called "free" shipping. What bothers me is that Amazon is doing to the rest of the economy what supermarkets and big-box did to Mom and Pop. Nobody even knows anymore what a mom-and-pop is. Amazon is doing the same to everyone else: Putting them out of business.

Paragraph five:

Research that starts with such a meaningless question as “labor’s share of GDP” was never likely to lead us to any profound answers. Workers do not receive shares of GDP – they receive shares of personal or household income.

I thought Cato guy might be on to something with that. Hey, you know? I always figure after a guy has two or three stupid ideas in a row he's bound to come up with a good one, just by dumb luck.

Nah. "Workers do not receive shares of GDP" he says, emphatically. But GDP is a measure of income. And workers do receive income. So it is okay to talk about “labor’s share of GDP”. Sure, to appease Cato guy, you could use GDI instead of GDP. But those two are really supposed to be equal, so Cato guy is complaining about nothing. Again.

That's enough. This Cato guy is not worth reading.

No, I can't let it go. I have to point out one more thing. Cato guy says

Workers do not receive shares of GDP – they receive shares of personal or household income.

Cato guy takes "labor share" and turns it into "worker's share". He takes the relevant macroeconomic concept (the split between labor and capital) and tosses it aside. In its place he puts you and your weekly paycheck. He brings it down to a personal level, and (bad as the argument is) we like him for it. Then he says that our weekly paychecks don't get counted in GDP. That part is just not true.

Cato guy turns "labor share" into a story of "the individual and his paycheck". And he tells us our weekly paychecks don't count in GDP. He mixes up ideas, and he lies.

Subscribe to:

Posts (Atom)