Here's the second graph from 4AM yesterday, Troy's graph tweaked:

|

| Graph #1: Percent Change from Year Ago, Employment (blue) and Consumer Debt (red) |

I said it shows "two lines that run pretty close together except in the 1960s and the 1990s". So I started thinking about subtracting the one line from the other, to look at where the differences arise. You never know if something like that will turn out to be interesting.

That's what makes it so interesting.

Yeah, two lines close together. Except they're on two different axles. Two different axes. The lines are pretty close together, but the numbers themselves are not. Where the blue line is zero, the red line is seven. Where the blue line is 10, the red line would be 23. The numbers are not usefully close. But the patterns are teasingly similar -- and yet intriguingly different during the 1960s and 1990s, the two decades of above-average economic performance. Intriguing.

Then I remembered a technique I learned from Lars Christensen. It goes

something like this:

Subtract from Series A the average value of Series A, and then divide by the standard deviation for Series A, and then multiply by the standard deviation for Series B, and then add the average value of Series B. At that point no further adjustment should be needed for comparing A and B.

That set of calculations I call "Christensen-fitting" the data. I don't know if it's a standard technique (and if so, what the name of that technique is) or if Lars Christensen invented it. But I like it.

So I downloaded the data from FRED and set to work.

I went right back to FRED then, changed the monthly PAYEMS series to quarterly so it matched the debt series, and downloaded the data again.

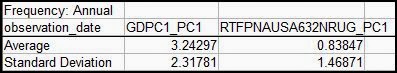

The CMDEBT data was intermittent before 1952Q4, so I deleted the data for both series before that date. Then all I had to do was find a spreadsheet with the calcs Christensen used, and duplicate the calcs. He used the STDEVPA() and AVERAGE() functions, so I did the same. Here are the numbers I came up with:

Next, I went back to FRED and plugged in the numbers for the Christensen-fit. Here is the result:

|

| Graph #2: The Christensen-Fitted Version of Graph #1 |

This graph looks very much like Graph #1 above. The difference is that now both datasets use the left axis. The PAYEMS numbers have been scaled and shifted to match the CMDEBT numbers.

(Hm. FRED must use a calculation very much like this to scale and shift the right-axis numbers, when two axes are used on a graph.)

Okay. Now that I have the employment numbers fitted to the debt numbers, I can subtract the one set from the other and see the difference:

|

| Graph #3: "Fitted" Employment Growth Date Less Debt Growth Rate |

Now it's getting interesting. Uptrend to about 1966. Downtrend to about 1980. Uptrend next, but not as rapid as before. Or maybe it's a low plateau in the 1980s and a higher plateau in the 1990s. And then a big drop -- but the big drop occurs about a decade

before the crisis. Now that's interesting.

I subtracted the debt growth rate from the employment growth rate. So where the line is below zero, debt growth is the bigger number. Again, where the line is below zero, the debt growth rate was faster than the employment growth rate... Well, I have to be careful here. The debt growth rate is

always faster than the employment growth rate. If I go back to the first graph and put everything on the left axis, it looks like this:

|

| Graph #4: Not Fitted, and On the Same Axis, Debt Growth (red) Is Way Faster |

The debt growth rate is always a lot faster than the employment growth rate, except there at the end, after the crisis.

Well, yeah. That's why I fitted the one series to the other. So we could compare them. But I have to be careful how I talk about it. So let me try again:

On Graph #3, I subtracted the debt growth rate from the "fitted" employment growth rate. So where the line is below zero, debt growth is the bigger number. That is, where the line is below zero, the debt growth rate was faster than the "fitted" employment growth rate.

Where Graph #3 is below zero,

the debt growth rate is relatively faster than the employment growth rate. Where Graph #3 is above zero, the employment growth rate is relatively faster than the debt growth rate.

Where Graph #3 shows a trend of increase (before 1967), the trend favors employment. Where it shows a trend of decrease (1967-1980) the trend favors debt growth.

I downloaded the "fitted" data from FRED, put it into Excel, and added a Hodrick-Prescott trend line to it:

|

| Graph #5: Same as Graph #3 (blue) with a Hodrick-Prescott Trend (red) |

(I'm repeating this graph in tomorrow's post. If you have any comments on my "lambda" value, save them up for that post!)

The trend favors employment till about 1967, then debt till 1980, employment till the mid-1990s, then debt again

since maybe 2003 ...

The trend favors employment till about 1967. That's interesting, I think. I have it

in my notes that Scott Sumner identifies the years 1952-1964 as

a big debt surge. But despite surging debt, employment grew more. Can that be right?

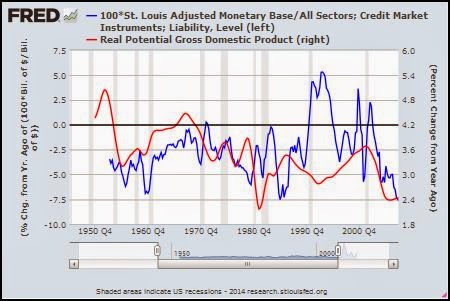

|

| Graph #6 |

No, of course not. Debt always increases faster than the number of jobs.

But look at it this way: From 1952 to the mid-1960s, employment was winning in a race of go-karts. At the same time debt was losing in a race among dragsters. Then from the mid-1960s to 1980 employment was losing among go-karts and debt was winning among dragsters. That's what Graph #3 and Graph #5 show, the Sumner debt surge of 1952-1964 notwithstanding.

Now look at it this way: The employment growth of 1952-1966 was faster, compared to employment growth of the whole 1952-2013 period, than the debt growth of 1952-1966 compared to debt growth of the whole period.

Debt growth in the early years was only moderate, as debt growth goes, while employment growth in those same years was very good, for employment growth.

Yeah, that's it.