Catherine Rampell writes in the New York Times, Sure Cure for the Debt Problem: Economic Growth:

We face the largest budget deficit the nation has ever known: $1.6 trillion, the equivalent of about 11 percent of our economy. And, whatever Washington does, many economists say the situation will grow only worse...

But there is, in theory, a happy solution to our debt troubles. It’s called economic growth. No need to raise taxes or cut programs. Just get the economy growing the way it used to.

Good luck with that...

But there is, in theory, a happy solution to our debt troubles. It’s called economic growth. No need to raise taxes or cut programs. Just get the economy growing the way it used to.

Good luck with that...

Good luck with that?? Catherine Rampell seems not to believe that the restoration of growth is possible, despite the title of her article.

“The basic issue is that the U.S. is on an unsustainable fiscal track,” says Dean Maki, the chief United States economist at Barclays Capital. “From that point, none of the choices are fun.” The most obvious choices, Mr. Maki says, are to reduce spending (ouch), raise taxes (yuck), let inflation run (gasp) or default (thud).

We wouldn’t need any of that if we could restore economic growth. If that happened, Americans would become richer and pay more taxes. Et voilà! — we’d pay down the debt painlessly.

We wouldn’t need any of that if we could restore economic growth. If that happened, Americans would become richer and pay more taxes. Et voilà! — we’d pay down the debt painlessly.

That is the only analysis of the problem in Rampell's article. Heck, it's the only one you'll find anywhere, except here at The New Arthurian Economics.

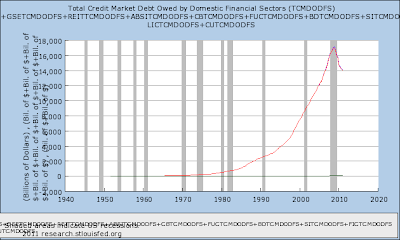

It is private debt, excessive private debt that hinders growth. Not public debt.

Since 1980 -- since Reagan -- we have been seriously trying to stop the growth of the Federal debt, with little or no success. Because it's the wrong debt.

After World War II, gross federal debt reached 122 percent of G.D.P., the highest ratio on record. But over the next 40 years, it fell to about 33 percent. That wasn’t because some blue-ribbon panel prescribed austerity; it was because the American economy became much, much richer.

The same happened during the prosperous 1990s, which began with deficits and ended with surpluses. Former President Bill Clinton is often credited for that turnabout, as he engineered higher tax rates. But most economists attribute the surplus years primarily to extraordinarily rapid growth.

The same happened during the prosperous 1990s, which began with deficits and ended with surpluses. Former President Bill Clinton is often credited for that turnabout, as he engineered higher tax rates. But most economists attribute the surplus years primarily to extraordinarily rapid growth.

After World War II, the Federal debt was large compared to private debt. Private debt was small and did not interfere with growth. So the economy grew. And over the next 40 years, private sector debt grew until the cost of it started to interfere with growth. Since then, economic growth has not been good... except briefly, in the late 1990s.

Something similar happened during the prosperous 1990s. In the late '80s and early '90s the rate of private debt growth fell substantially. This reduced costs and opened a window for growth. Then in the late '90s the economy grew enough to balance the Federal budget! But soon, the level of private debt was high again, and the economy was refusing to grow.

Congress has promised fiscal discipline for decades, only to undo its promises before the reckoning. Fiscal discipline is painful, unpopular and, in today’s Washington, as elusive as the prosperity we once had.

Congress has tried to achieve fiscal discipline for decades, without success. Why? Because reducing the Federal debt is the wrong approach.

We must reduce private sector debt, to free up the economy to grow again, and then the economy will grow.

When the economy grows, then we can balance the Federal budget.

"A version of the NY Times article appeared in print on July 31, 2011, on page BU1 of the New York edition with the headline: A Sure but Elusive Cure: Economic Growth."