Yup. Still Sumner.

In the comments on his

no such thing post, Scott Sumner wrote

The amount of ice cream you want at a fixed price level is quantity demanded. One of the most basic concepts in economics is that one should never confuse demand and quantity demanded.

You're being a dick again, Scott. You're doing that cliquey thing economists do. To somebody who doesn't understand the concept, restating the concept more rigorously doesn't make the concept clear. It just makes you look like a dick.

See how I'm using simple words to get the point across?

As I understand the concept (which may very well be not as economists understand it)

aggregate demand means "totaled up" demand. I don't need a degree in economics to understand that, because

I know what the word "aggregate" means.

Maybe you guys have invented some other meaning for the word "aggregate". I wouldn't be surprised. I know you have some other meaning for the word "real".

//define aggregate demand

Okay. I looked it up.

Pikiwedia says

In macroeconomics, aggregate demand (AD) is the total demand for final goods and services in an economy at a given time. It specifies the amounts of goods and services that will be purchased at all possible price levels. This is the demand for the gross domestic product of a country. It is often called effective demand ...

The first sentence of that excerpt is exactly what I think. The second sentence says something completely different. It's another "compromise" paragraph, written by people who change each others words.

The second sentence refers to goods "purchased at all possible price levels". This is what I think you are referring to, Scott, as "demand" as opposed to "quantity demanded". Something like

• If we sell it for one cent, we will sell 100 of them, but

• If we sell it for two cents, we will sell 99 of them, but

• If we sell it for three cents, we will sell 98 of them, but

• If we sell it for four cents, we will sell 97 of them, but

• If we sell it for five cents, we will sell 96 of them, but

• If we sell it for six cents, we will sell 95 of them, but

• If we sell it for seven cents, we will sell 94 of them, but

and so on,

for all possible price levels. (Clearly, at Wikipedia they don't know what "

all possible price levels" means.) (To shorten the list, I have left out the selling price of 1.10 cents, and 1.20 cents, and 1.11 cents and 1.12 cents, and 1.111 and 1.112 and 1.1111 and 1.1112 cents and infinitely many other "possible" price levels.)

Come to think of it, I don't know what Wikipedia means by demand for final goods and services "at a given time". The total demand for final goods and services

during a given time period is GDP for that time period. The total demand

at a given point in time is not GDP; it could be something else. Is that what you mean, Scott? Okay, I see it now. But we're talking about when time is stopped, as opposed to when time is moving forward. As I see it, if time is not moving

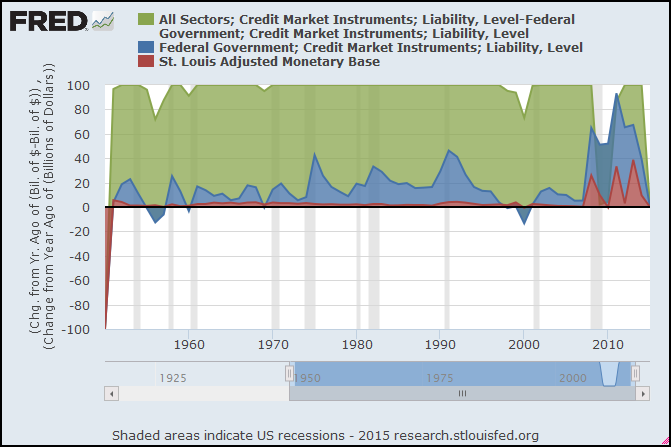

there can be no demand. If we stop time, imaginarily stop time, we can do things like count up the money that's in M1 or add up the total amount of debt outstanding.

But you can't buy anything when time is stopped. You can only look at numbers. I don't know if that makes sense to you, Scott. It makes sense to me.

I'm also not sure what Wikipedia means by the word

will: "goods and services that

will be purchased at all possible price levels." They don't say "could be purchased" or "would be purchased" or "might be purchased". There's nothing conditional about it. They predict the future boldly. If they had been talking about the past instead, they'd have said "goods and services that

were purchased at all possible price levels." I really don't know what that could mean, but I'm sure it makes at least as much sense as Wikipedia's version.

// a demand

schedule

The nonsense table I made up just above -- if we sell it for 1 cent, if we sell it for 2 cents, if we sell it for 3 cents, etc. -- that's a

demand schedule, isn't it. Keynes wrote about that stuff:

... the volume of employed resources is duly determined, according to the classical theory, by the two postulates. The first gives us the demand schedule for employment, the second gives us the supply schedule ...

I was trying to imagine a train schedule, one that lists all the times during the day that a train will stop at the station, and where it will go. Change that to "demand schedule", one that lists all the possible prices we can buy stuff at, and what we will buy at each price. Yeah, that doesn't seem to help. Anyway, it's all hypothetical. The word "will" certainly doesn't belong there.

I looked it up.

Investopedia:

DEFINITION of 'Demand Schedule'

In economics, the demand schedule is a table of the quantity demanded of a good at different price levels. Thus, given the price level, it is easy to determine the expected quantity demanded.

They crack me up. It is "easy" to determine the expected quantity demanded,

but only after you have created your list of the quantity demanded

at every possible price level. Or, not to be a dick, at every

reasonable price level.

And it's easy to

make up such numbers. Economics textbooks are littered with 'em. But that's not the same as actually knowing how many you would actually sell at each of those price levels.

This demand schedule can be graphed as a continuous demand curve on a chart having the Y-axis representing price and the X-axis representing quantity.

INVESTOPEDIA EXPLAINS 'Demand Schedule'

A demand schedule is typically used in conjunction with a supply schedule showing the quantity of a good that would be supplied to the market at given price levels. Then, graphing both schedules on a chart with the axes described above, it is possible to obtain a graphical representation of the supply and demand dynamics of a particular market. Ceteris paribus, the market will reach equilibrium where the supply and demand schedules intersect. At this point, the corresponding price will be the equilibrium market price, and the corresponding quantity will be the equilibrium quantity exchanged in the market.

So (to refresh our memory) Scott Sumner said

One of the most basic concepts in economics is that one should never confuse demand and quantity demanded.

I think he means that demand (i.e., the

aggregate demand schedule) is not measured by how many you sell, but by how many you would sell at all the different possible price levels, or, again, at all the different realistic price levels.

Cliffs Notes seems to resolve a few things:

In macroeconomics, the focus is on the demand and supply of all goods and services produced by an economy. Accordingly, the demand for all individual goods and services is also combined and referred to as aggregate demand. The supply of all individual goods and services is also combined and referred to as aggregate supply. Like the demand and supply for individual goods and services, the aggregate demand and aggregate supply for an economy can be represented by a schedule, a curve, or by an algebraic equation

The aggregate demand curve represents the total quantity of all goods (and services) demanded by the economy at different price levels.

So yeah, Scott and Cliff seem to agree, and I seem finally to understand what they were trying to tell me. But I still don't buy it. "Demand" is measured by what we actually in fact buy. Period. How much we could buy today, once we start the clock, at a whole array of different price possibilities, that is not demand. It is a "demand schedule" -- an imaginary list of possible sales volume numbers for all those different prices.

As far as I can tell, however, this dismal distinction between "demand" and "demand" gives us no clue as to why there may be

no such thing as global aggregate demand. So, as far as I can tell, when Sumner said

The amount of ice cream you want at a fixed price level is quantity demanded. One of the most basic concepts in economics is that one should never confuse demand and quantity demanded.

he was simply being a dick.

.png)

.png)

.png)

%2Band%2BHSTCMDODNS%2B(red).PNG)