Table 1.14 shows "Gross value added of corporate business" along with a list of the component parts of GVA. The table also shows GVA of "financial corporate business" and of "nonfinancial corporate business". There's no list of components for financial corporate, but there is one for nonfinancial corporate.

Add financial and nonfinancial GVA together on a graph, and they completely cover over the "corporate business" GVA. It's a near perfect match. So I'm thinking I can take the "corporate business" component list and subtract the "nonfinancial corporate" component values, and this will give me the "financial" components. Then I can compare the financial and nonfinancial corporate data.

I'll remind you that what they call "nonfinancial" I call "productive" business, and that what they call "financial" I call "nonproductive". For some reason, they put financial ahead of nonfinancial in Table 1.14. I'd put them the other way around, and use my labels. I guess it depends what you think is more important.

Here's financial-relative-to-nonfinancial GVA (red) nicely centered on corporate-minus-nonfinancial-relative-to-nonfinancial GVA (blue):

|

| Graph #1: Financial GVA relative to Nonfinancial GVA |

| CE | Compensation of Employees |

| OS | Operating Surplus |

| GVA | Gross Value Added |

So, for example, the above graph is abbreviated as FGVA/NGVA, the ratio of financial to nonfinancial Gross Value Added.

For Compensation of Employees, financial gained on nonfinancial from 1945 to 1980, and then gained on it even faster:

|

| Graph #2: Compensation of Employees, Financial relative to Nonfinancial: FCE/NCE |

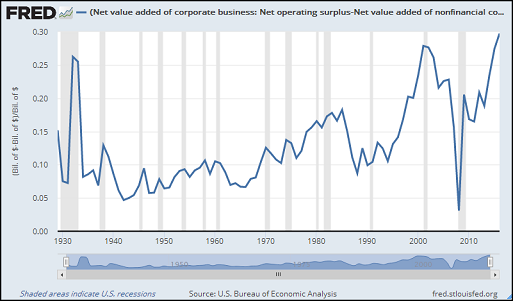

In part (3) of this series of posts I had in mind to subtract net interest from corporate profits, but I found out that net interest is not included in corporate profits, so I threw that idea away. For the graph below, I went the other way: I used Operating Surplus, which is profits plus net interest plus some other thing.

|

| Graph #3: Operating Surplus, Financial relative to Nonfinancial: FOS/NOS |

I noticed that coming out of WWII, compensation of employees (Graph #2) increases from 0.04 to something over 12 by the end of the graph. But the operating surplus (Graph #3) increases to maybe 25 by the end. I got the impression that the operating surplus (net interest and profit) is increasing quite a bit faster than employee compensation.

Is it? Look at the CE ratio relative to the OS ratio, Graph #2 divided by Graph #3:

|

| Graph #4: Compensation of Employees F/N Ratio relative to Operating Surplus F/N Ratio (FCE/NCE)/(FOS/NOS) |

So I'm left thinking that the problem, if one is visible in this data, the problem is not found in the increase of profit and interest relative to employee compensation. Rather, the problem would have to be in the growth of corporate finance in general, relative to nonfinancial corporate business. That problem is clearly visible in Graph #1.

// The Excel file

No comments:

Post a Comment