I want to look at each of the images used for yesterday's animation sequence. Each of the similarities, I mean. But I'm having a hell of a time getting started with the writing. So I'm gonna just start.

Image #1: No lag... Similarity: January 1919 - November 1930

|

| Graph #1: No Lag |

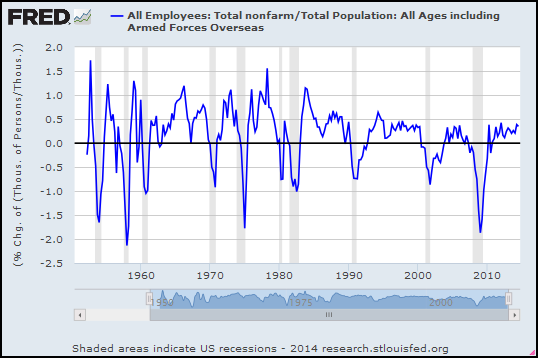

I'm using another FRED graph, monthly data, same two series shown in the animation sequence, to see

the dates of similarity. Maybe that'll move the writing along.

I will describe a "lag" in terms of how many months I have to offset the Base Money (black) graph to the right to obtain a highlightable period of similarity. I will describe a "similarity" using the dates of the Inflation (red) graph, the one that doesn't move back and forth thru time.

The similarity highlighted in Graph #1

ends suddenly in late 1930, when it appears the Federal Reserve suddenly decided to do something about the Great Depression. Just after the yellow highlight ends, base money (black) shoots up while the rate of inflation falls for six months more (till

June 1931) and then drags bottom at -10% till

March 1933.

That separation of the lines shows the lag developing.

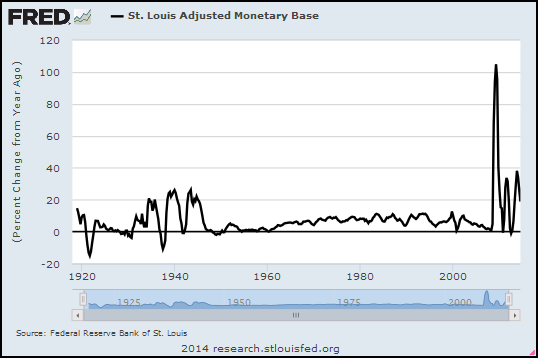

Image #2: Lag 29 months... Similarity March 1933 - March 1934

|

| Graph #2: Base Money Lagged Two Years |

During the similarity highlighted on Graph #2, base money (black) increased from

November 1930 to

October 1931 -- a period of eleven months. The rate of inflation (red) increased from

March 1933 to

March 1934 -- twelve months. So the lag itself was a month longer at the end of the similarity than it was at the start.

At the start of that similarity the lag (November 1930 to March 1933) was 28 months. By the end of that similarity, it was 29 months. I'll call it 29 months.

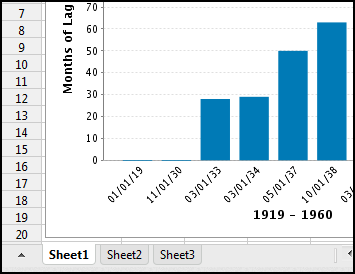

Image #3: Lag 50 months... Similarity March 1934 - May 1937

|

| Graph #3: Base Money Lagged Four Years |

On Graph #3 the similarity starts with the peaks that end Similarity #2. The lag this time is clearly visible as a downtrend that's twice as long for the red as for the black, followed, then, by a more hesitant red uptrend. The similarity ends with rather modest peaks in both the red and black lines.

Note -- This image has been revised. Originally I showed one yellow stripe of highlight, running through those modest peaks. (You can see that version in

yesterday's post.)

Incidentally, the peaks that end Similarity #2 no longer appear aligned because on Graph #3, base money (black) is shifted two additional years to the right. (If that doesn't make sense, go fiddle with the

interactive experiment graph again.)

The end of this similarity is the highlighted peak of the black line in

March 1933. And for the red line, in

May 1937. The difference -- the time the black line is lagged -- is 50 months.

Image #4: Lag 63 months... Similarity May 1937 - October 1938

.PNG) |

| Graph #4: Base Money Lagged Five Years |

Number four is a brief similarity. I'm figuring that it runs from the end of Similarity #3 to the start of the highlighted jiggles just before the black line skyrockets.

For the black line it starts with the end of Sim #3 (March 1933) and ends in

July 1933.

For the red line it starts with the end of Sim #3 (May 1937) and ends in

October 1938.

It's a challenge to get the dates right on these graphs, what with these images lagged (but not providing pop-up info windows) and the FRED graph providing the info windows (with nothing lagged). It's making my head spin. Hey, if you see anything that looks like a mistake, let me know.

Image #5: Lag 92 months... Similarity October 1938 - March 1951

|

| Graph #5: Base Money Lagged Seven Years |

For this one the similarity will start with the jiggles where the previous similarity ended. So

July 1933 for the black line, and

October 1938 for the red, these dates mark the start.

Where to end this similarity? For the black line I'm gonna go with the high point in the third tall spike in the group of three, so

July 1943

For the red line I'm gonna stop it at the top of the third red spike of three,

March 1951.

The highlighting is a bit off from these dates that I'm choosing now. It's a little bit arbitrary, choosing the dates. If you know a better way to figure it, do let me know.

(It's

completely arbitrary.)

Image #6: Lag 74 months... Similarity March 1951 - March 1955

|

| Graph #6: Base Money Lagged Six Years |

We reached a maximum lag of 92 months (between 7 and 8 years) with Graph #5. On graph #6 the lag begins to recede. I'm calling the dates for this similarity as follows: For the black line, start at

November 1944 and end at

September 1949.

For the red line, start at

March 1951. And end at, I'll say

March 1955

For the red line, I start Similarity #6 where #5 ended. For the black line I'm leaving a little gap. Number six starts at the black peak where the yellow highlight starts. But number five ended at the nearby, higher, slightly earlier peak. So there is a brief gap between similarities at that point.

Note that other than this brief gap, and the dis-similarity described under Image #1, there are no gaps where one similarity ends and the next one begins. Granted, this is all by eye, and arbitrary. But these "similarities" are nothing but short sections of the overall graph, short enough that we can compare them and describe them.

But if the similarities connect like railroad cars, then what we're seeing is that the pattern of the red graph and the pattern of the black graph are actually quite strikingly similar. The main difference between the two lines is nothing more than a lag -- a long and variable lag. And I'm thinking that the best way to show similarity would be with an "accordion axis" if I knew how to make such a thing.

I'm also thinking that this accordion axis would essentially be a standard axis modified by a calculation that shortens or lengthens the time units in an irregular pattern. I want to create such an axis, because I want to take that calculation and see what it looks like as a normal graph. If it has a familiar look, if it reminds us of something, then perhaps we will have found a major component of the rise and fall of this lag.

Image #7: Lag 60 months... Similarity March 1955 - May 1960

.PNG) |

| Graph #7: Base Money Lagged Five Years |

On Graph #7 the lag recedes again. I begin Similarity #7 where similarity #6 ended:

September 1949 for the black line and

March 1955 for the red. I end the red one in

May 1960. And I end the black one at

May 1955. We end with a five-year lag.

I figured these start- and stop-points by looking for similarities in the patterns. Tomorrow I'll graph the lag lengths.

.PNG)

.PNG)

.png)