I put output-per-hour and compensation-per-hour on a graph, for both the Business Sector and the NonFarm Business Sector. Indexed all the lines to the start date so they all start at the 100 level. Then I subtracted 50 from the Nonfarm Business numbers to shift them down on the graph. Now we can compare productivity-and-compensation for the business sector (blue and red) to productivity-and-compensation for nonfarm business (green and purple). Through 1970 only:

|

| Graph #1: Productivity and Compensation 1947-1970 for Business & Nonfarm Business |

As I said before, the numbers are indexed. Both business-sector lines start at 100. But we know compensation was actually less than the value of output, because somebody made a profit.

We know compensation was less than the value of output, but we don't know how much less. From the indexed data, we cannot tell.

I messed with that all day, how much less, and made no progress. So I'm moving on.

I'm looking at the early years. Real compensation and real output run together for a while, then separate for a while, then run together, then separate. There's no inflation in these numbers, but they do show compensation falling slightly behind output, or catching up, or sometimes maybe gaining on it.

And I remember James Forder saying

Samuelson and Solow published a widely read paper in the May issue of the American Economic Review of 1960. It discussed the causes of inflation, the Phillips curve, and related matters. Discussion of their paper frequently says that it presented the Phillips curve as a stable, exploitable relation, and hence played an important role in the development of inflationary policy. This is hardly so...

The question [Samuelson and Solow] were addressing was that of the explanation of the inflation of the 1950s – particularly the period 1955-57 – and the implications it had for macroeconomics. Mild though that was later to seem, this 'creeping inflation' as it was called was, at the time, a source of much anxiety.

I think Samuelson and Solow had caught a case of cost-push inflation. Ah, the great ignored cost-push inflation. It fascinates me. That's where science advances, in the ignored areas, once they stop being ignored. It's where the interesting questions are.

I'm wondering about the

|

| Graph #2: The Business Sector Compensation Price Index (blue) and other Price Measures |

Focus, Art. The measure of inflation in business sector pay is different from the others. I wonder what the rate of inflation looks like...

|

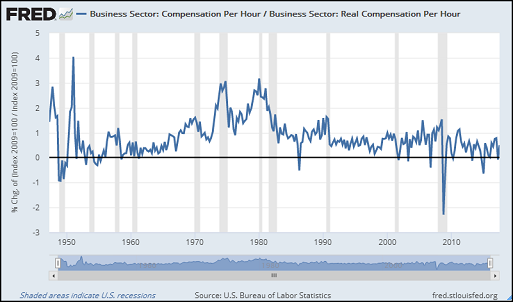

| Graph #3: The Rate of Inflation in Business Sector Compensation |

The "Great Inflation" shows up right on schedule: Compensation inflation increases beginning in the mid-60s. And it peaks with the 1970 recession, the 1974 recession, and the 1980 recession. Plus you can see the near-recession of 1967 in a brief, sudden fall from the trend of increase. It's all there, all of it. But, like Samuelson and Solow, I am fascinated by the inflation of 1955-57.

I notice FRED has data for both current dollar output and real output for the business sector. So I can get another price index, a "business sector output" price index. I'll put that inflation rate on the graph along with Business Sector Compensation inflation. And again I'll cut off everything after 1970, to get a close-up view of the early years.

|

| Graph #3: The Rate of Inflation in Business Sector Compensation |

If it's true, I would expect to see on Graph #1 that the "output" line rises relative to the "compensation" line coming out of the 1954 recession. It does. The output line was already above the compensation line during the '54 recession, but the gap opened more in '55.

The gap closed in '56 as compensation inflation scooted up to the 1% level. So I can imagine that prices (i.e., output prices) were rising after the '54 recession, and it took until '56 for wages to react.

I want to subtract Compensation Inflation from Output Inflation of the business sector. This will show me the portion of rising business sector prices that is not due to labor.

I told ya: The ignored areas, that's where the most interesting questions are.

For both the Business Sector Compensation Price Index and the Business Sector Output Price Index, I take the nominal data at FRED and divide it by the inflation-adjusted data. I use the default units (Index 2009=100) and the default frequency (Quarterly).

After the division, in the "Finally, you can change the units of your new series" part of the FRED window, I set the units to "Percent Change". In order to do more arithmetic after that, I have to export the data to Excel.

In Excel I receive the quarterly inflation rates for business sector compensation and business sector output. I subtract the compensation number from the output number. This gives me the inflation in the price of business output which is not due to the cost of labor. I put that on a graph.

Then I go back to FRED for the quarterly inflation rate as measured by the GDP Deflator. I add this to my graph in Excel so I have a context: something to compare against business non-labor inflation. Here is the result:

|

| Graph #5: Non-Labor Inflation in the Business Sector |

The blue line is the inflation in business output, with the inflation in employee compensation subtracted out of it. What remains in the blue line is the inflation in business output which is not due to labor.

The blue line runs mostly below the red. This stands to reason, if only because labor-cost inflation does not show up in the blue line. In the early '60s, for example, the trends of red and blue run parallel, with red a little higher. Then in the latter 1960s as the Great Inflation took hold, business non-labor inflation falls behind overall GDP inflation.

The first years on the graph show inflation immediately following the Second World War. The red runs much higher than the blue. This could be attributed to government, rather than business or labor. Similarly, in 1951-52 the red runs extremely high, related this time to the Korean War.

Now look at 1953-1956. In '53 the blue is flat at zero. The red is flat and a little higher, comparable to what we saw for the early 1960s. Then in 1954 and 1955 the lines move upward from the zero level, reaching the 1.0 level. The 1.0 level is 1% inflation quarterly, or about 4% per year. That's what Samuelson and Solow were looking at.

Notice that during this transition the red and blue run together, sometimes touching, and sometimes even with the blue above the red. There is essentially no gap between the lines during this time, from before 1954 to after 1955 (1953 Q4 to 1956 Q1).

In other words, during all of 1954 and all of 1955, business sector non-labor inflation was responsible for inflation as measured by the GDP Deflator. Labor costs are excluded from the calculation. Labor cannot be held responsible for the inflation of those years.

I think that's pretty interesting.

3 comments:

I've been looking into Ivan Kitov's thoughts on the CPI and the GDP Deflator and how, since the late 1970s, they no longer run parallel.

If you look at the Deflator relative to the CPI, the ratio runs flat until 1968 and then pretty flat until 1978 and then downhill fast. It's an interesting phenomenon.

Equally interesting, the early years: the ratio runs pretty flat before 1954 and pretty flat since 1956. But during 1954 and 1955 the ratio increases noticeably.

This has to be related to the Samuelson and Solow thing.

at this link

https://www.cnsnews.com/news/article/terence-p-jeffrey/us-has-record-10th-straight-year-without-3-growth-gdp

these remarks:

Before this period, the longest stretch of years when real GDP did not grow by at least 3.0 percent, as calculatd by the BEA, was the four-year stretch from 1930 to 1933—during the Great Depression.

In addition to that four-stretch from 1930-1933, there have also been four three-year stretches where the real annual growth in GDP did not go as high as 3.0 percent. Those periods were 1945-1947 (in the immediate aftermath of World War II); 1956-1958; 1980-1982; and 2001-2003.

In particular, the 1956-1958 period. Not to be missed.

Michael McCarthy at Jacobin says:

"After wage and price controls were lifted in the wake of World War II, inflation jumped up from 8.5 percent in 1946 to 14 percent in 1947. At the time, many in Congress argued that a key cause was the spread of industry-wide union contracts that included wage increases."

Samuelson and Solow, in their opening, say:

"... at the time of the 1946-48 rise in American prices, much attention was focused on the successive rounds of wage increases resulting from collective bargaining."

McCarthy fills in a blank for me.

Post a Comment