The St. Louis Fed's Featured Economist on 25 April morning was William T. Gavin, whose latest work is

What Is Potential GDP and Why Does It Matter?, Federal Reserve Bank of St. Louis Economic Synopses, Apr 20

Short PDF, page and a half, my kind of stuff.

Gavin says PGDP is a measure of the best we can do in an imperfect world. Fair enough. He says policymakers estimate PGDP by smoothing out actual GDP. And he admits that "the accuracy of our estimate depends on the accuracy of our long-term forecast."

He also points out the importance of PGDP: Policymakers use it to set policy.

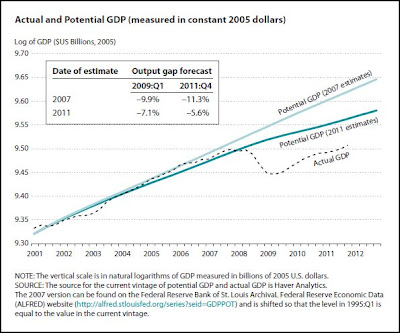

Gavin provides a graph showing two versions of PGDP: one from just before the crisis, and one from a few years after:

The higher level of potential GDP was estimated in 2007 and the lower level in 2011. The reduced 2011 estimate reflects the impact of sluggish GDP growth over the past three years.

Since they don't know how to bring conditions up to meet expectations, policymakers are lowering their expectations to match conditions.

|

| Source: What Is Potential GDP and Why Does It Matter? (PDF) |

See that box there on Gavin's chart? The box shows that the 2007 estimate was wrong by almost 10% in 2009, and by more than 11% in 2011. But the 2011 estimate was off by only about 7% in 2009, and by about 5½% in 2011. The implication is that the newer estimate is better: If the forecast is less wrong, it must be better, right?

Lest I am too subtle: The reason we study the economy is to make things better. Not to put the best face on failure.

1 comment:

Well played, sir!

Cheers!

JzB

Post a Comment