From The New York Times:

House Republicans Resume Efforts to Reduce Fed’s Power

By BINYAMIN APPELBAUM, JULY 10, 2014

WASHINGTON — House Republicans frustrated by the Federal Reserve’s expansive economic stimulus campaign and its growing role as a financial regulator are renewing their efforts to constrain the central bank.

The Fed would be required to set monetary policy based on a published formula under legislation introduced this week by leading Republicans on the Financial Services Committee. Other bills would eliminate the Fed’s responsibility to maximize employment, or eliminate the Fed entirely.

The bills face uncertain prospects in the House, and have no future in the Senate while it remains under Democratic control. But they highlight ideas that Republicans are likely to revisit if they win a majority in both houses of Congress in the midterm elections.

“We have seen a radical departure from the historic norms of monetary policy conduct,” Representative Jeb Hensarling of Texas, who is chairman of the Financial Services Committee, said at a hearing on Thursday. “Monetary policy is at its best in maintaining stable, healthy economic growth when it follows a clear, predictable rule or path.”

By BINYAMIN APPELBAUM, JULY 10, 2014

WASHINGTON — House Republicans frustrated by the Federal Reserve’s expansive economic stimulus campaign and its growing role as a financial regulator are renewing their efforts to constrain the central bank.

The Fed would be required to set monetary policy based on a published formula under legislation introduced this week by leading Republicans on the Financial Services Committee. Other bills would eliminate the Fed’s responsibility to maximize employment, or eliminate the Fed entirely.

The bills face uncertain prospects in the House, and have no future in the Senate while it remains under Democratic control. But they highlight ideas that Republicans are likely to revisit if they win a majority in both houses of Congress in the midterm elections.

“We have seen a radical departure from the historic norms of monetary policy conduct,” Representative Jeb Hensarling of Texas, who is chairman of the Financial Services Committee, said at a hearing on Thursday. “Monetary policy is at its best in maintaining stable, healthy economic growth when it follows a clear, predictable rule or path.”

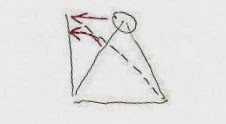

It's easy to draw a triangle with all sides equal:

And it is easy to draw a triangle with one square corner:

But it is impossible to draw one triangle that has all sides equal and one square corner:

We want to take the top corner of the all-sides-equal triangle (circled) and slide it over to the left (upper red arrow) to make one square corner. When we do that, the one side of the triangle slowly rotates to the left (lower red arrow) and the other side of the triangle stretches out and gets longer (dashed line). But as soon as that side starts to stretch out, the triangle is no longer all-sides-equal, and we have failed at our task!

This sort of thing is obvious to someone like me, who makes AutoCAD drawings eight hours a day. In AutoCAD you can literally grab that corner of the triangle and move it, and you can see what happens when you do.

So if the boss comes to us and says I want an equilateral right triangle, well, it just can't be done.

The boss probably wouldn't come to us with that request. But he does come to us with equally impossible requests. Usually he'll tell us the features he wants in the drawing. And when we draw it, sometimes there is a combination of features that simply cannot be done. I think it's because he's looking at the big picture and not the little details. That's okay. That's my job, the little details.

But if I tell the boss it can't be done -- and if I'm right, of course -- then it can't be done, whether he understands the reason or not. If he gets red in the face and tells me Just slide that top corner over to the left until the bottom corner is square I can do it -- because he's no longer telling me to keep all sides equal. His required combination of features has changed. But he's red in the face, and he doesn't want to hear my story.

To me, the economy is like the triangles. There are some things that just cannot be done. There are other things that can be done. But the boss -- Congress -- is red in the face and doesn't want to hear it. Just make interest rates obey the Taylor Rule he says. Just slide that top point over to the left. Don't worry about keeping all sides equal.

"Monetary policy is at its best in maintaining stable, healthy economic growth," according to Representative Hensarling, "when it follows a clear, predictable rule or path."

Well yeah, that could work. But it won't work if it's the wrong rule or the wrong path. Suppose the rule is we always want debt to grow a little faster than the quantity of money. Think that rule would work? It would work for a while, I guess, like in the 1960s; then it would start to fail, like in the 1970s. Finally we'd give up on the ideas that worked in the 1960s -- most of them, but not the idea that we always want debt to grow a little faster than the quantity of money, because we always want that. And the changes would change things -- we discover thirty years later -- when deleveraging becomes suddenly fashionable.

What's that you said? They wouldn't do that? You mean, they would never say we always want debt to grow a little faster than the quantity of money? Is that what you think? I think you're wrong:

|

| Graph #1: Debt (blue) and Money (green) compared to GDP (red) |

Oh -- see the green line? On the right there. The last half inch of it, or less, where it's no longer flat and so close to zero that it is almost invisible: See it? There around 2009, where it starts to go up. You've seen that before. Everybody showed it to you. By itself, it looks like this:

.JPG) |

| Graph #2: Base Money (green), the same as on Graph #1 |

It is troubling, I admit. But the increase that looks so troubling on Graph #2 is really next to nothing compared to the growth of debt, as you can see on Graph #1.

It was the growth of debt for half a century and more that was the real problem -- the growth of debt at a more rapid pace than the growth of money, for half a century and more. The shocking and dismaying increase in money we see on Graph #2 was the response to the long period of excessive debt growth: the response to the problem created by the growth of debt.

The increase in money visible on Graph #2 was the response. If you don't believe me, go ask Ben Bernanke.

It is Graph #2 that bothers Representative Hensarling of Texas. He wants the Federal Reserve to follow "a clear, predictable rule or path" and to keep monetary policy on the straight-and-narrow. Hensarling doesn't want the Fed making the quantity-of-money side of the triangle suddenly long. He wants to keep it good and short. He's not happy with the increase in the green line visible on Graph #2.

That's fine. But by itself, his plan won't work. To make it work you have to make sure that the quantity-of-debt side of the triangle also stays good and short. Really, this is just a broadening of the "clear, predictable rule or path" that Hensarling wants.

So there it is, in writing, the Arthurian formula.

16 comments:

Instead of fucking with the Federal Reserve, Congress must begin tearing down the incentives it has set up to encourage the use of credit. It can replace those incentives with incentives to accelerate repayment of private debt.

There is a necessary balance between the quantity of money and the quantity of debt. When debt expands too much, the only solutions are

1. to increase the quantity of money, as Ben Bernanke did; or

2. to reduce the quantity of debt by every means possible.

I argue for the latter.

Umm.... Bank credit is money. Just because private banks can't create US currency doesn't mean they can't create money.

For any given level of income inequality, there is a growth rate in the money supply (both public and private) that will correspond with a desired economic growth rate. The less equal the income, the more money that needs to be created.

We have relied far too heavily on private money creation through bank credit expansion to support our growth. But thats not the only way to grow the money supply. The Govt can always grow the money supply through larger deficits without increased bank credit.

If the economy needs $1 Trillion a year in new money (its actually more likely twice that amount at least given our levels of inequality), then what is the optimal contribution ratio towards that $1T from the public and private sector?

50-50?

70-30 Govt?

70-30 private?

These are the questions we need answers for

"Umm.... Bank credit is money. Just because private banks can't create US currency doesn't mean they can't create money."

Ummm......... Are you saying there is no difference between bank-issue and government-issue?

No, I'm not saying there is no difference.

But your claim that

Govt IOU's = money

Bank IOU's = NOT money

is just factually wrong.

I don't think I said banks don't create money. I do say that banks create money and debt, both, by lending. And I claim that money and debt are not the same thing.

And you're not even including all Govt money (all CB Balances), only reserves. The thing you are leaving out is that every single T-bond in existence was "bought" with reserves.

So the Govt has actually created about $18T, $14T of which are in savings accounts (securities) at the Fed and $4T are in checking accounts (reserve) accounts at the Fed.

your entire post was about how we need more money because we have so much debt.

The reality is we have so much money because we have so much debt, as you pointed out in your previous comment loans create the deposits.

So what we need is more Govt money and less bank money, but they are both money. reducing the money supply is what causes depressions. So we need to continue to increase the money supply. we should just do it with private sector POV debt-free money from the Govt and not private sector debt money.

"your entire post was about how we need more money because we have so much debt."

No.

When debt expands too much, the only solutions are

1. to increase the quantity of money, as Ben Bernanke did; or

2. to reduce the quantity of debt by every means possible.

I argue for the latter.

You repeated some version of this line:

"the growth of debt at a more rapid pace than the growth of money"

five times in your piece. The evidence is right there. I really enjoy your site, you are just simply wrong about the nature of the two things here. Nothing wrong with misstating things at times, everyone does it.

Oh and QE does not increase the quantity of money. Thats why its not stimulative to the broader economy.

It exchanges dollars in securities acccounts for dollars in reserve accounts, no new dollars are created.

You are no richer the day after your T-bond matures than the day before.

Auburn Parks, you said: "We have relied far too heavily on private money creation through bank credit expansion to support our growth."

That is exactly the same thing I show in my Graph #1.

I agree with much of what you say in your remarks here. But we are working from different definitions of money.

For example (if I have it right) you consider government securities to be money. (You say: "So the Govt has actually created about $18T, $14T of which are in savings accounts (securities) at the Fed...") So I think you are saying government securities are money.

I see it this way: The government needs a dollar, and some rich bitch has a dollar. So the government creates a new security and sells it to the bitch for a dollar.

Now the government has the dollar and the bitch doesn't: The government has the money and the bitch doesn't. They can't both have money because there is only one dollar to be had.

The security will be money in a year or, more correctly, will be exchanged for money in a year. In the meanwhile it is not money. (It is, at best, "near money".)

If the government took out a loan from a private bank, the loan would create money. But the government prefers to borrow the money from someone who has it, in a transaction that does not create new money.

If the evolution of finance has created the situation where government securities are somehow *used* as money, well, that's part of the problem, isn't it.

"That is exactly the same thing I show in my Graph #1."

No, but only because of semantics in this case. That chart only shows reserves, which are not the only type of Govt money.

"For example (if I have it right) you consider government securities to be money. (You say: "So the Govt has actually created about $18T, $14T of which are in savings accounts (securities) at the Fed...") So I think you are saying government securities are money."

How can they not be? Do you not consider a 6-month CD to be part of your money supply?

Why would a 6-month T-bill be any different?

"I see it this way: The government needs a dollar, and some rich bitch has a dollar. So the government creates a new security and sells it to the bitch for a dollar."

The Govt is the monopoly issuer of the US Dollar per the Constitution and counterfeiting laws. There cannot be a time when the Govt needs a dollar.

"Now the government has the dollar and the bitch doesn't: The government has the money and the bitch doesn't. They can't both have money because there is only one dollar to be had."

The bitch still has his money, its just in a term deposit account, in the exact same way as you don't lose your money when its in a BofA term deposit account instead of an on-demand account.

Here's another way to think about it in a logical tautology way:

The Fed is the monopoly issuer of Reserves +

The TSY is the monopoly issuer of T-securities +

T-securities can only be "bought" with reserves =

In the agggregate, the Funds to buy Treasuries can only come from the Fed.

Which can be broken down further into Mosler's rule "the Funds to buy Govt securities can only come from the Govt"

"The security will be money in a year or, more correctly, will be exchanged for money in a year. In the meanwhile it is not money. (It is, at best, "near money".)"

I understand that this line sounds logical, but T-bonds are not like corporate bonds or municipal bonds because they are guaranteed by the Govt. The Govt promises to exchange one type of liability it has a monopoly over with another type of liability it has monopoly over.

Google and Chicago both agree to give you back something that they don't control. This is analogous to a gold or fixed FX standard. Where the Govt would promise to convert one type of liability it has a monopoly over with something it does not. This is fundamentally different than T-securities.

"If the government took out a loan from a private bank, the loan would create money. But the government prefers to borrow the money from someone who has it, in a transaction that does not create new money."

I actually don't see how this is even possible. The Govt doesn't want Chase bank IOUs, it only spends and taxes in its own IOUs. Chase cannot loan money to the Govt (besides from the flawed concept of loaning the Govt money by depositing your money into term savings accounts at the Fed), as Chase doesn't control reserves.

Chase can create its own IOUs or bank deposits in exchange for your promissory note but it cant create Govt IOUs to lend to the Govt. Or think about it this way, Bank of America doesn't want Chase deposits or IOUs, thats why they settle in Govt IOUs.

"If the evolution of finance has created the situation where government securities are somehow *used* as money, well, that's part of the problem, isn't it."

Just because I can't buy a burrito with the money in my 6-month term deposit at Chase doesn't mean I don't have that money.

I really appreciate your site and hard work.

"When debt expands too much, the only solutions are

"1. to increase the quantity of money, as Ben Bernanke did; or

"2. to reduce the quantity of debt by every means possible.

"I argue for the latter."

The two are not mutually exclusive. Increase the amount of money in people's hands so that they can pay down their debt.

The problem is, when the Fed increases the quantity of money, it does not necessarily get into people's hands. Gov't spending is better at getting money into people's hands.

Hey, Min.

"The problem is, when the Fed increases the quantity of money, it does not necessarily get into people's hands. Gov't spending is better at getting money into people's hands."

I don't argue that what the Fed has done since 2008 was the right stuff.

I argue that since at least the 1970s, policymakers should have known that you can't keep increasing debt more rapidly... uhh... you can't keep increasing bank-issue more rapidly than government-issue money.

In order to know what policy is right for the lat five years, one must examine the previous five decades.

With regard to government spending getting money into people's hands, and the success of that as policy, move your mouse onto and then off the graph at this old post.

You can draw a triangle with three right angles on a sphere. Like maybe: Cameroon, Singapore, North Pole.

Yes...

"The classical theorists resemble Euclidean geometers in a non-Euclidean world who, discovering that in experience straight lines apparently parallel often meet, rebuke the lines for not keeping straight as the only remedy for the unfortunate collisions which are occurring. Yet, in truth, there is no remedy except to throw over the axiom of parallels and to work out a non-Euclidean geometry. Something similar is required today in economics." - JMK

Post a Comment