It is true, to follow up on yesterday's post, that for Nonfinancial Corporations the share of real assets has been falling, while the share of financial assets has been rising:

|

| Graph #1: Financial (red) and Nonfinancial (blue) shares of total Nonfarm Nonfinancial Corporate Assets |

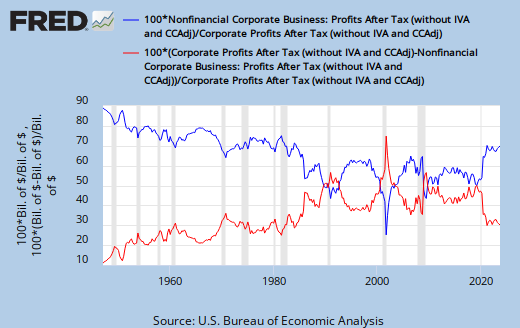

It is also true, as we observed some time ago, that the profit to Nonfinancial Corporations has been falling as a share of Total Corporate Profits, while that of Financial Corporations has been on the rise:

|

| Graph #2: Financial (red) and Nonfinancial (blue) shares of total Corporate Profits |

This gets me wondering about what is left as the profit from real assets to Nonfinancial Corporations, if we take their profit from Financial assets and count it with the profit of Financial Corporations.

I suspect the profit from real assets has been falling and is rather low. Why do I think this? Because economic growth is not good, and because profit is the engine that drives enterprise.

I'm gonna assume that the split between Financial and Nonfinancial profit of NNCB, Nonfarm Nonfinancial Corporate Business, follows the same pattern as the split between assets shown on Graph #1 above.

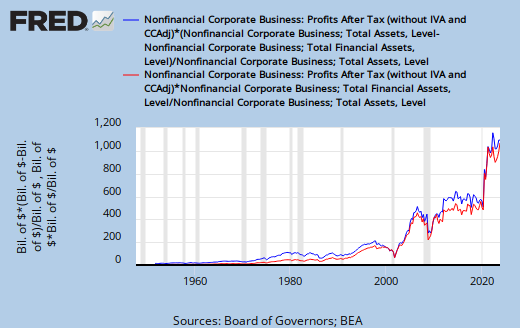

Starting with Graph #1, and factoring in FRED's Nonfinancial Corporate Business: Profits After Tax shows us the profit to Nonfinancial Corporations arising from Financial and Nonfinancial sources, in billions:

|

| Graph #3: Financial (red) and Nonfinancial (blue) Profits arising from Nonfarm Nonfinancial Corporate Assets |

Profits from the two sources have become nearly equal. But I remind you that Graph #3 shows the profit of Nonfinancial corporations only. Now we shall add the profit of Financial corporations. I add it to the red line -- to the Financial profit of Nonfinancial corporations:

|

| Graph #4: Total Corporate Profits from Financial sources (red) and Productive sources (blue) |

It may clarify the picture, to see this profit breakdown expressed as percent of total corporate profits:

|

| Graph #5: Percent of Corporate Profits from Financial sources (red) and Productive sources (blue) |

In the 1950s, about 60% of corporate profits came from real production, and the rest from finance. During most of the Great Inflation, the ratio was 50-50.

Today, about 25% of corporate profits come from real production. Three quarters comes from finance. From other people's debt.

5 comments:

Nice work.

Can you imagine what will happen to equity valuations when that 75% share of profits from financial assets largely vaporizes , a process that's underway as we speak ?

Either share prices collapse , or taxpayer money fills in the profit hole.

Somebody has to lose.

Forgive us our debts as we forgive our debtors...

Thank you!

Bezemer & Hudson, Finance is Not the Economy, quoting Greta Krippner: “One indication of financialization is the extent to which non-financial firms derive revenues from financial investments as opposed to productive activities.”

Yup.

In Chapter 9 of the General Theory, Keynes identifies subjective factors that can "affect the amount of consumption out of a given income". Among the factors that may influence the decisions of corporate business he lists "the motive of improvement":

"to secure a gradually increasing income, which, incidentally, will protect the management from criticism, since increasing income due to accumulation is seldom distinguished from increasing income due to efficiency".

To clarify that last, Keynes says that the "motive of improvement" may reduce business investment in productive capital by shifting funds to financial investment. I made bold the part where he says profits from financial investment are just as good as profits from productive investment at the microeconomic level.

I didn't quote the part where he says they are not just as good, at the macro level.

Post a Comment