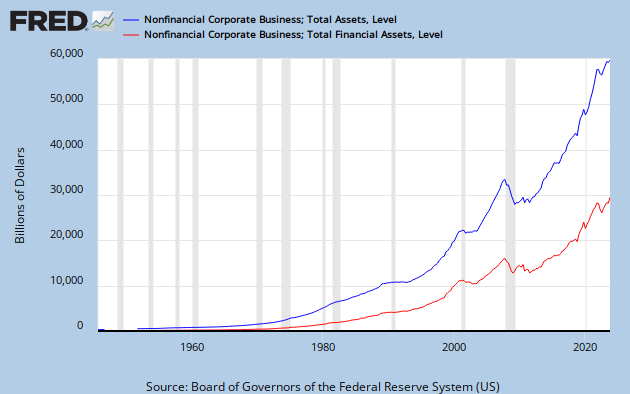

The Random Eyes sidebar link turned up a comparison of two items from Nonfarm Nonfinancial Corporate Business balance sheets: Totals Assets, and Total Financial Assets:

|

| Graph #1: FRED's #3AO |

Everything below the red line (down to the zero line) is financial assets; everything above it, up to the blue line, is productive assets.

If I divide the red line values by the blue line values, and multiply by 100 to convert to percent, I get to look at the history of financial assets as a percent of total assets, for Nonfarm Nonfinancial Corporate Business:

|

| Graph #2: Financial Assets as a percent of Total Assets |

Half the assets of non-financial corporations are now financial assets.

Tax law made that happen. I'm sure of it.

2 comments:

The implication, of course, is that tax law can make it NOT happen, too. Tax law can reduce this imbalance, and change things back to the way they were.

Of course, we must first be aware of the imbalance and see it as a problem.

I completely agree with this view. Unfortunately the struggle making the public concerned with these tax distortions. So much of discussion today is focused on monetary or fiscal policy, but not the enormous number of imbalances created through tax expenditures or other tax laws (which don't show up as spending or even directly count against the budget deficit). This will be an uphill battle but it's definitely worth it.

Post a Comment