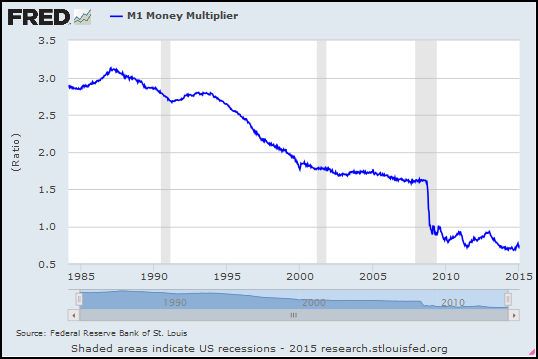

The money multiplier:

|

| Graph #1: The FRED series MULT, the Money Multiplier |

It goes down.

On their NOTES tab, FRED says "The M1 multiplier is the ratio of M1 to the St. Louis Adjusted Monetary Base." There is a data series for M1, and there is a series for the Base, and we can divide the one by the other to get the ratio. Doing that, the ratio goes farther back in time than the mid-1980s:

.PNG) |

| Graph #2: The Money Multiplier, going back to 1959 |

It's not what you'd call stable. If you were the Fed, you could put a dollar into the economy and see it become $3.50 or so -- but that worked only briefly in the 1960s. Your dollar would have become $3 if you did it sometime in the 1970s. $2.50, briefly, in the mid-90s, then $2 around the year 2000, and then a little over a buck and a half, just before the crisis.

Then it dropped straight down to the 1.0 level, where the Fed adding a dollar to the economy resulted in no further increase at all. And now it is below 1.0, so that when the Fed adds a dollar to the economy, only about 75 cents actually makes it into the economy. The monetary multiplier has fallen to less than one.

People argue about the fiscal multiplier and whether it's greater than one. People who favor government spending say yes. People who oppose government spending say no. They argue, I guess, because there's no clear evidence.

But there is clear evidence for the monetary multiplier, and it is clearly less than one. Monetary stimulus, in other words, is most definitely not working. The money multiplier is less than one.

Okay, so we know that monetary policy is not working. But there is no clear evidence regarding fiscal policy. What should we do? What would you do? I know what policymakers do: They rely on monetary policy, because the fiscal multiplier is low.

No comments:

Post a Comment