What is "circulating money? It is spending-money. It is the money you receive as income, and it is the income that you spend (but not the money in your savings account). Economists call it M1 money. FRED calls it M1SL. The red line here:

|

| Graph #1: Money (red) and Income (blue) Indexed for Comparability |

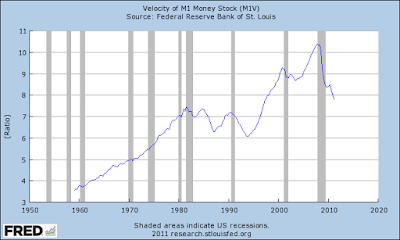

The overall trends show that income (the blue line) has gone up faster than the amount of circulating money. In order for this to happen, it must be true that money has tended to move faster over time. And it has. The velocity of money shows a general upward trend:

|

| Graph #2: Velocity of Money |

Overall, the velocity of M1 money has indeed tended to increase over time.

The trend of velocity shown on Graph #2 is not a smooth upward trend. The trend of M1 (the red line on Graph #1) is not a smooth upward trend. Do you suppose there is any relation between these two facts?

|

| Graph #3: Velocity, and Income relative to M1 Money |

Yeah.

The irregularities in Velocity arise from irregularities of money growth, not from irregularities of income.

Between the 1982 recession and the mid-1990s, there are three brief accelerations, speed bumps in the growth of M1 money -- each larger than the one before. The first [1983-1985] is barely visible. The second [1986-1989] is noticeable, and the third [1992-1997] is obvious.

|

| Graph #4: Money (red) and Income (blue) Not Indexed this time |

In each case after the speed bump, the trend line falls back to the earlier long-term trend. Significantly, the graph shows M1 money in billions of dollars, not a rate of change. So it was the actual number of dollars that increased extra-quickly (to create the bump) and then extra-slowly (to return to the long-term trend).

The three aberrations strike me as some kind of experiment with the monetary system.

These three increases in the quantity of money do not lead to comparable increases in income. On Graph #4, the bumps that appear on the red (money) trend line do not appear on the blue (income) trend line.

Disposable Income shown on the graph is nominal, or actual income. It is not inflation-adjusted. So, increases due to inflation, if there are any, would show up in the blue trend line on Graph #4. No such increases follow the three speed bumps of the M1 Money trend.

But not only do the effects of this money growth *not* show up in Disposable Income. The effects show up elsewhere! The effects show up as a reduction in the velocity of money. The three speed-bumps in the Money trend appear as three brief downtrends on the Velocity graph. This is not a coincidence. It is a result of policy.

The three speed-bump increases in the quantity of M1 money did not push prices up. They pushed velocity down. This evidence contradicts what Milton Friedman said about the quantity of money as a cause of inflation.

Contrary to what you might expect, there is no clear and obvious relation between the quantity of money and the level of income. The intermittent accelerations of the money supply do not show up on the Disposable Personal Income trend.

They do, however, appear as reductions of velocity. This suggests that our economic behavior is not changed by the increases in money. Rather, our incomes grow normally -- as you might expect -- and the increase in money translates into less spending per dollar.

6 comments:

Hi Art,

I've been looking at this chart. It is a comparison of the money stock to GDP. During expanding credit bubble the ratio of money to GDP was about .5 at all other times money stock appears to be around .6*GDP.

Federal borrowing money from private investors seems to have also dropped down from its "normal" tragectory during the bubble period.

Govt. borrowing is related in that the money stock would have fallen without that increase in borrowing. Of course so would GDP.

Here is a chart showing History of non-government US credit expansion and contraction

-jim

Hey jim. Everybody has their favorite version of the money supply. Interesting chart, your first link. DEFinitely interesting.

But for me, M2 includes circulating money and money in savings. Circulating money is being spent; money in savings is not. I think one must get into a discussion of credit-use and debt, to explain the effect of savings.

Hey, I was away for the weekend. My son Aaron got married. Now I'm home and unwinding with a little White Zinfandel, and it's working, but I cannot give your chart the attention it deserves. But I'm going thru the motions at FRED as I write these notes, and I NEVER would have multiplied GDP by 0.6 as you did. Nice work.

For tomorrow's post (5 Sept) I will go with my scheduled follow-up to today's. But for Sept 6 I will have something on my graph and yours.

I never would have THOUGHT to multiply GDP by 0.6, I mean. hic.

Hey - you gained a daughter!

From our earlier conversations, we both know that Friedman was wrong when he said that inflation is always and everywhere a monetary phenomenon.

I will some day get to doing the relevant post.

I'm trying to digest the relatoinships these charts show - your's too, jim. I may need a Tums.

Cheers!

JzB

Hi Art

I wasn't thinking in terms of how to define circulating money.

The chart was the result of a thought experiment in response to those who say the govt needs to immediately extract itself from debt.

Obviously, to accomplish that task in short order would involve taxation that would empty every wallet, checking and saving account. And there would be a 100% asset tax on privately held US Treasuries. Those holding the treasuries could turn them in to pay the tax.

If successful this effort would pay down the 14.3 trillion owed and leave about 2.7 trillion which the govt could meet its spending obligations under current law for about 8 months without debt.

Congratulations to your son.

-jim

Jim, I just finished up my post for the 6th. Obviously, it leans in the direction that *I* am thinking...

"If successful this effort would pay down the 14.3 trillion owed and leave about 2.7 trillion which the govt could meet its spending obligations under current law for about 8 months without debt."

Eight months, huh? Is that enough time to get the Tea Party re-elected??? If not, the government might have to cut even more spending!

Oh, don't make jokes, Art.

Yours is an interesting approach: Testing the practicality of the call for elimination of government debt.

Post a Comment